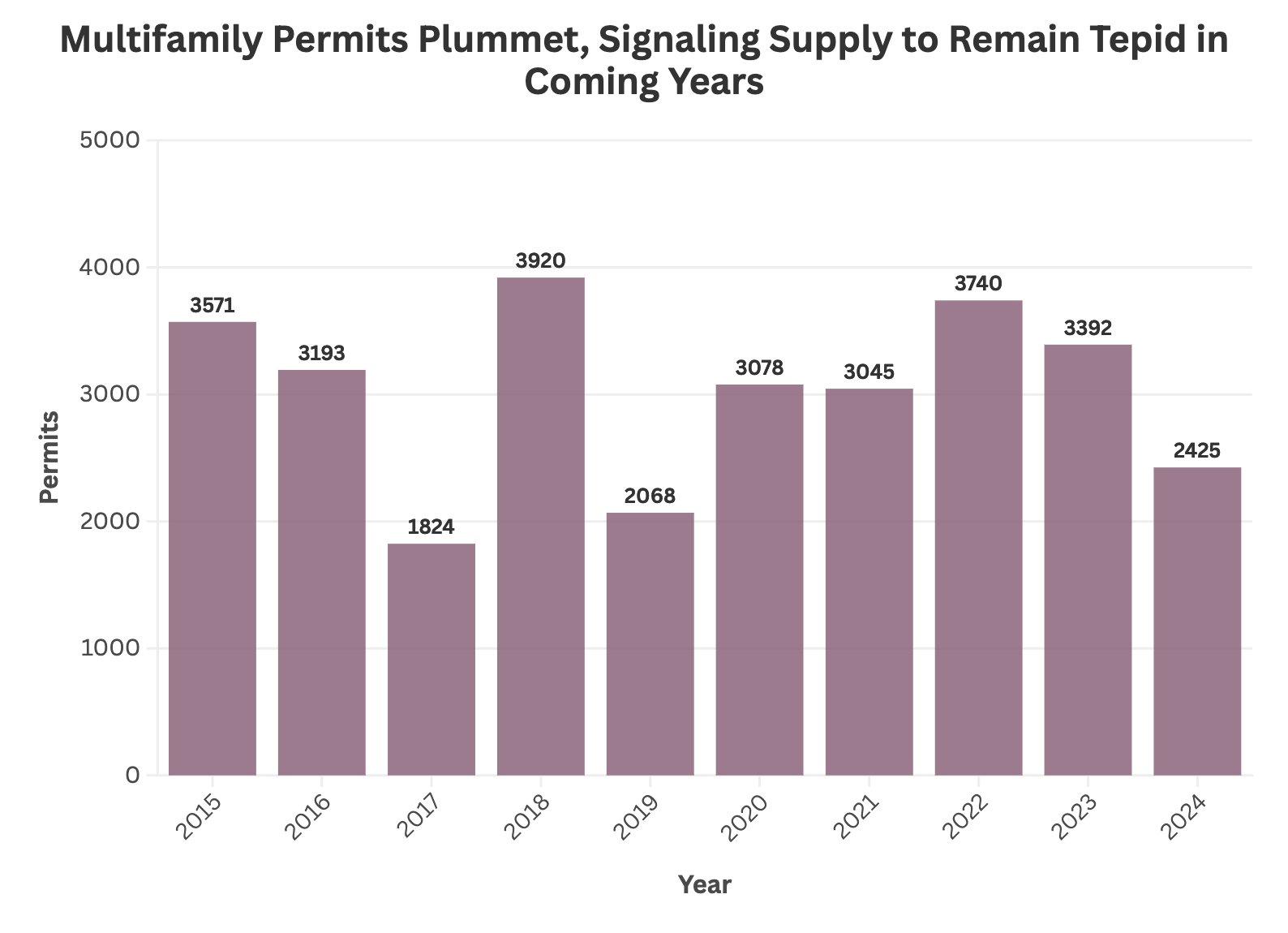

Baltimore’s multifamily construction landscape is undergoing a significant shift. While the metro has seen steady apartment development over the past few years, the number of permitted projects has dropped by 40% in 2024, signaling a slowdown in future supply. At the same time, rising construction costs and financing challenges are reshaping how developers approach new projects.

Rental demand is expected to remain high in 2025, partly driven by affordability challenges in homeownership. High mortgage rates, stricter lending conditions, and elevated home prices continue to push many would-be homebuyers toward renting instead. With fewer new apartments being built in the next few years, this could lead to continued rent growth, especially in high-demand areas.

A Shrinking Pipeline: Fewer Deliveries Ahead

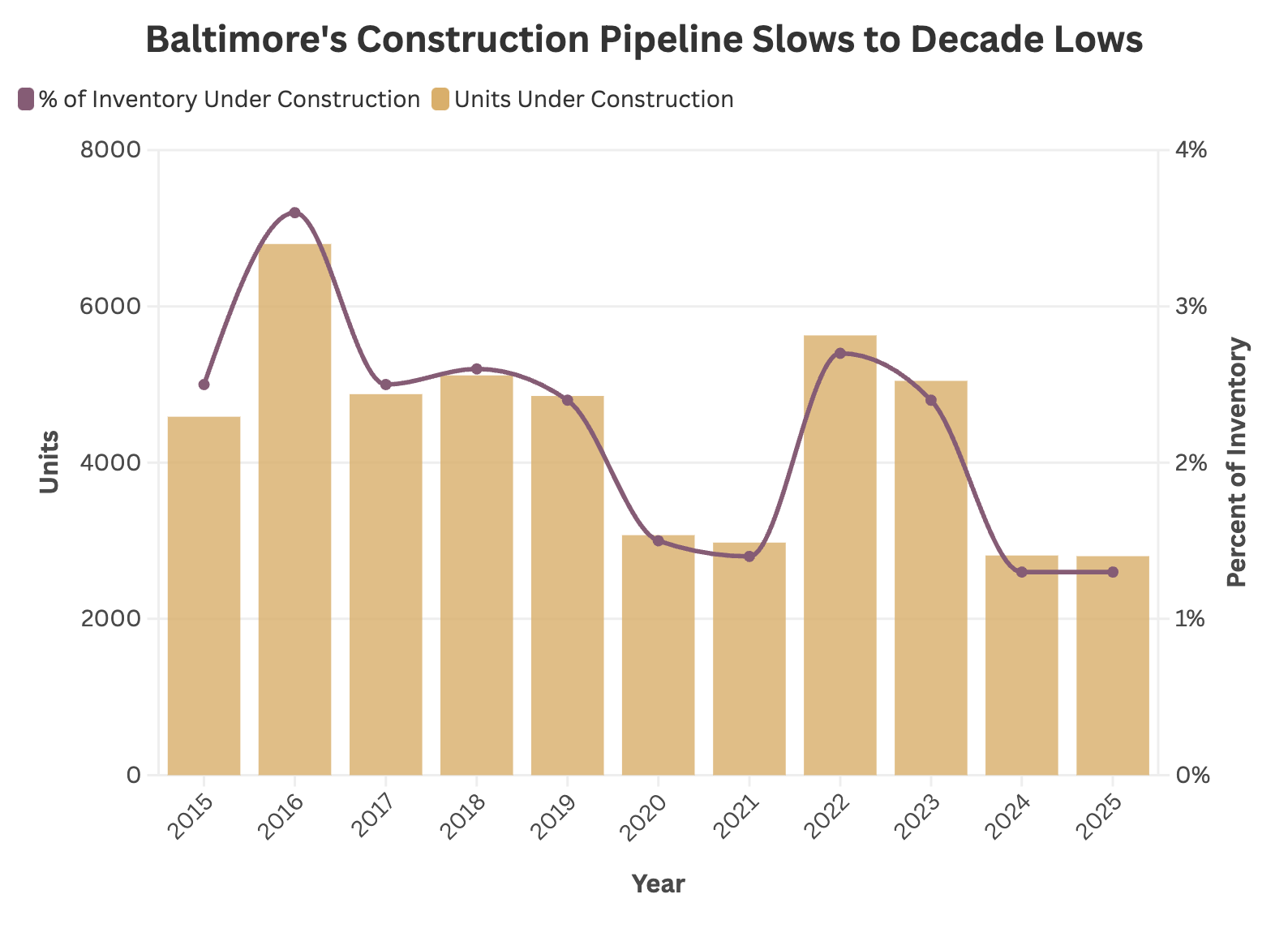

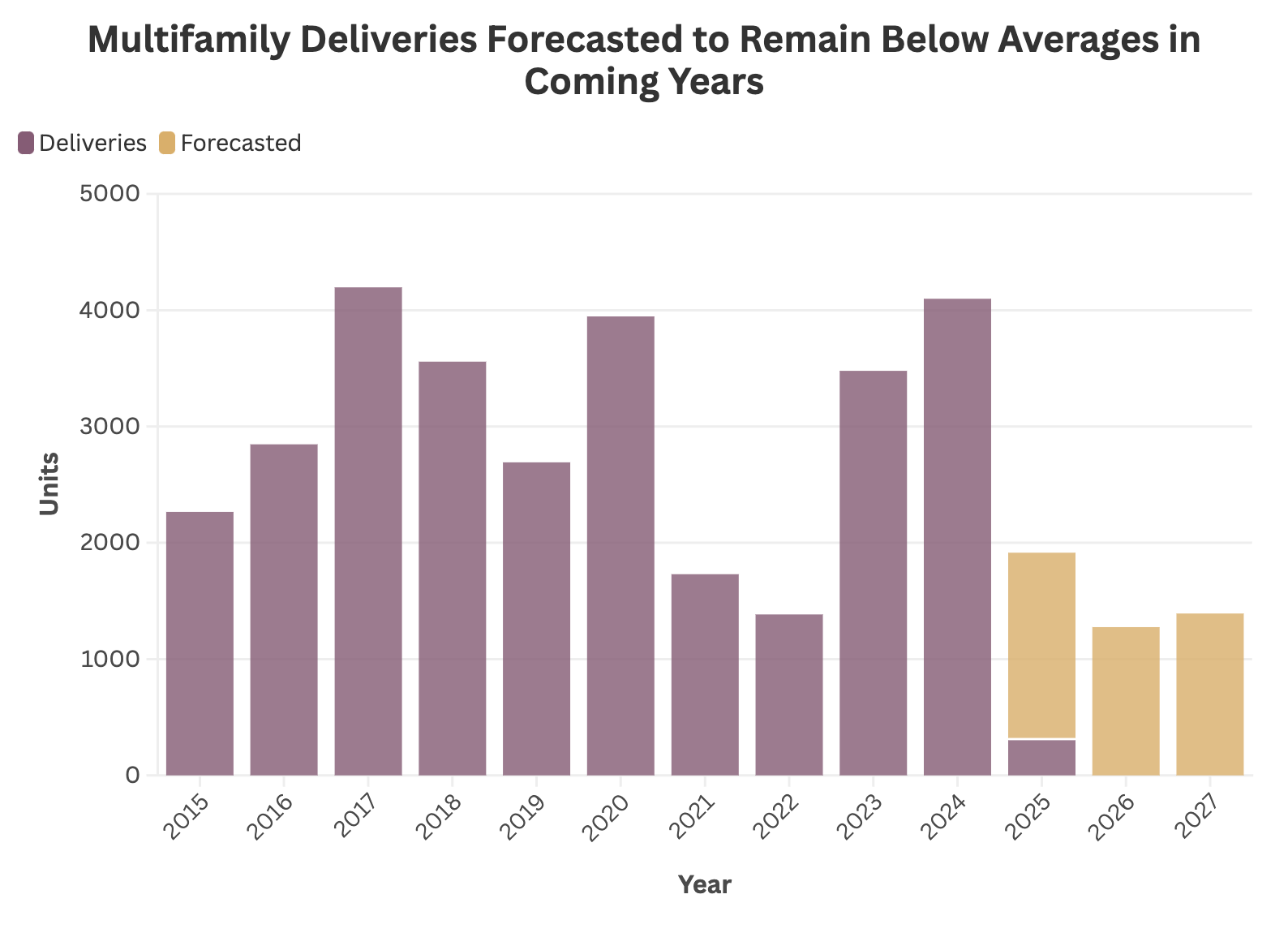

Baltimore’s multifamily development pipeline peaked in early 2023 with nearly 6,000 units under construction. That number has since fallen to 2,800 units, roughly 1.3% of total inventory as of Q1 2025, and new construction starts have steadily declined since early 2024.

This slowdown means fewer apartments will be delivered in 2026 and 2027, likely creating a tighter rental market as supply shrinks. However, developers continue to focus on high-demand, city-based submarkets like Canton, Fells Point, Harbor East, and Federal Hill, which delivered more than 2,300 units in the past two years and has roughly 700 units underway.

Source: CoStar

Rising Costs and Financing Challenges Reshape Development

One of the biggest hurdles for new multifamily construction in Baltimore is financing. Interest rates remain elevated, and rising construction costs have made it more difficult for developers to justify new projects.

Many of the luxury apartment complexes opening today were financed when interest rates were historically low during the pandemic. But with borrowing costs significantly higher in 2024 and 2025, developers are facing new pressures:

• Construction slowdowns: The number of multifamily permits issued in 2024 dropped by 40%, signaling a pullback in new development.

• Uncertainty in the market: Higher financing costs have made it harder to launch new projects, leading to delays and adjustments in project pipelines.

• Shift in investment strategies: Investors are increasingly focusing on mid-tier, value-add opportunities rather than new high-end construction, looking to renovate and reposition older properties.

Source: Census, Baltimore MSA

*Data as of December 2024

Office-to-Residential Conversions

As ground-up multifamily development slows, adaptive reuse projects—particularly office-to-residential conversions—are gaining traction. However, not all conversions are progressing smoothly. Some projects have faced financing difficulties and stalled redevelopments, reflecting the broader challenges of Baltimore’s central business district.

Among Baltimore’s most notable office-to-residential conversions currently underway:

• 222 St. Paul Place: The former Embassy Suites Inner Harbor Hotel was acquired by Arctaris Impact Investors for $7 million in late 2024 and is set to be converted into 300 workforce housing units by mid-2026. Arctaris is investing $30 million in the project, which will create a mix of studio, one-bedroom, and three-bedroom apartments. The redevelopment will also include street-level retail, potentially featuring a coffee shop, and is expected to attract state employees, hospital workers, and university staff moving into the area.

• 210 N Charles St. (Fidelity & Deposit Building): Previously owned by the late Peter Angelos, former owner of the Orioles, the historic financial building is being converted into 231 apartments, with completion expected in early 2025. The redevelopment is led by Trademark Investments, who is also the new owner of One Charles Center, a neighboring office tower that will remain office space.

These conversions are critical in revitalizing Baltimore’s central business district, turning underutilized commercial properties into much-needed housing. However, the success of these projects will depend on renter demand, financing conditions, and continued investment in the downtown area.

What This Means for Rent Growth

With fewer units coming online in 2025, Baltimore’s rental market is expected to see continued rent growth, particularly in areas with strong demand.

• High homeownership costs are keeping more people in rentals, as elevated mortgage rates and home prices make buying unattainable for many households.

• Mid-tier apartments will likely continue to see strong demand as renters seek affordability.

• Workforce housing and conversions will play a growing role, helping to absorb demand from residents priced out of luxury units.

While luxury apartment pricing may see some adjustments, demand for rental housing is expected to remain strong, especially in walkable, transit-friendly areas where new supply is limited.

Baltimore’s multifamily market is at a turning point. While new developments continue in key submarkets, a combination of higher costs, declining permits, and shifting investment strategies is reshaping the landscape.