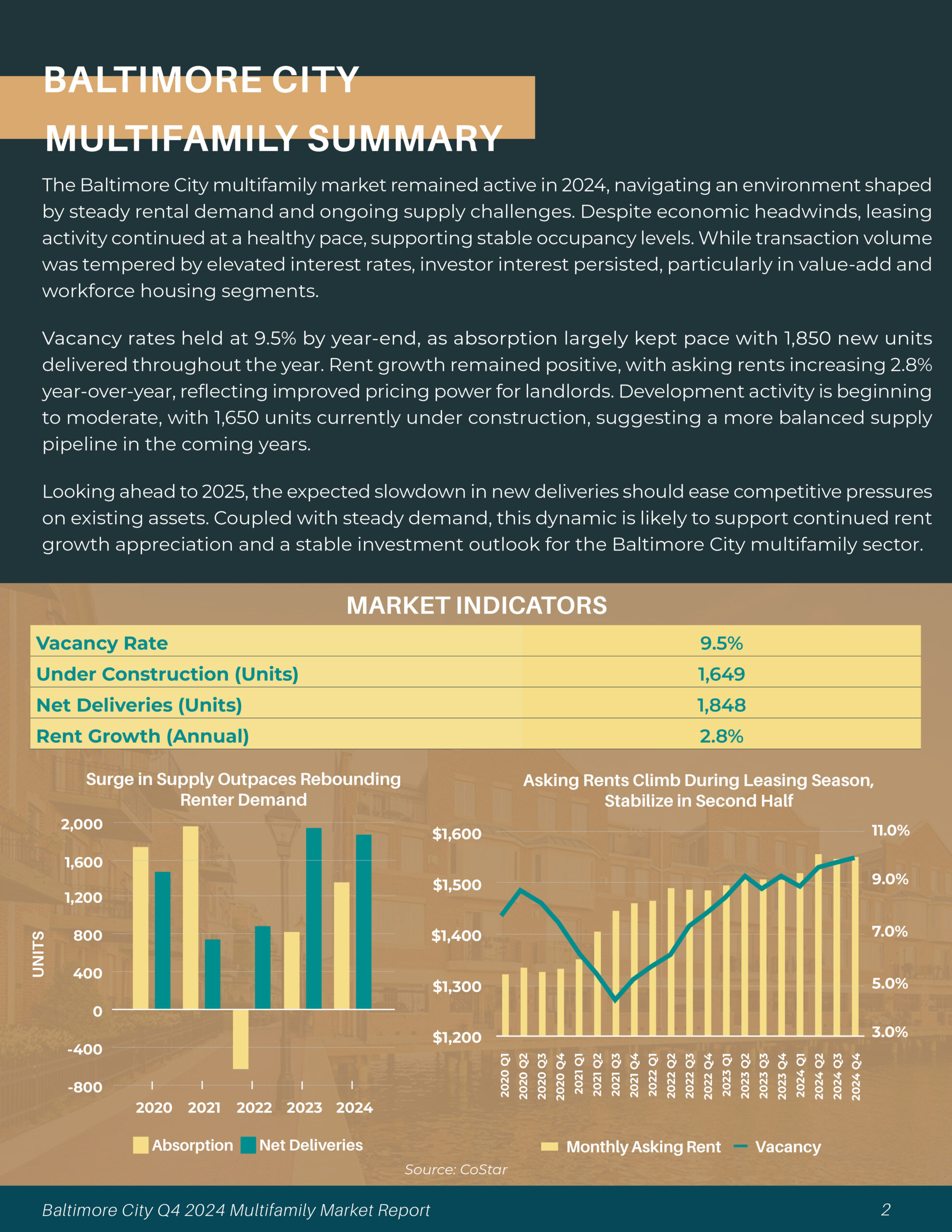

Key Takeaways:

• Baltimore City Multifamily Sales Rebound

Multifamily sales in Baltimore City surged past $460 million in 2024, marking the third-highest transaction volume of the past decade. Investor confidence has returned as rent growth stabilizes and vacancy rates level off, particularly in value-add and workforce housing segments. Despite elevated interest rates, demand for well-located properties remains strong, signaling a resilient investment market.

• Development Pipeline Slows Amid Future Supply Constraints

Baltimore’s multifamily development pipeline has slowed significantly, with only 1,650 units currently under construction, a sharp decline from peak levels in early 2023. Fewer projects are breaking ground, and office-to-residential conversions persist Downtown. Major projects like the 222 St. Paul Place and 210 N. Charles St. redevelopments highlight the growing role of adaptive reuse in the city’s rental market.

• Investors Target Garden & Townhome-style Multifamily

Investors continue to target value-add opportunities and suburban neighborhoods outside Baltimore’s core downtown. Northern Baltimore City has seen minimal new development and remains a strong focus for investors, especially for garden and townhome-style apartments. With tighter credit conditions, many buyers pursue alternative financing strategies to navigate the higher interest rate environment.