An Update on Baltimore City’s Multifamily Market

Multifamily Market in Minutes

Multifamily Market in Minutes is a brief overview of key trends and figures related to commercial investments in Baltimore. Three figures to know thus far in 2023 are:

$66.3 Million YTD = Total Sales Volume in 2023

More than $66 million has transacted so far in 2023, a sizable decrease in overall deal activity. Investor interest remains strong for well-positioned assets with value-add opportunities. Also, loan assumptions remain an attractive alternative to obtaining new financing due to the higher cost of capital.

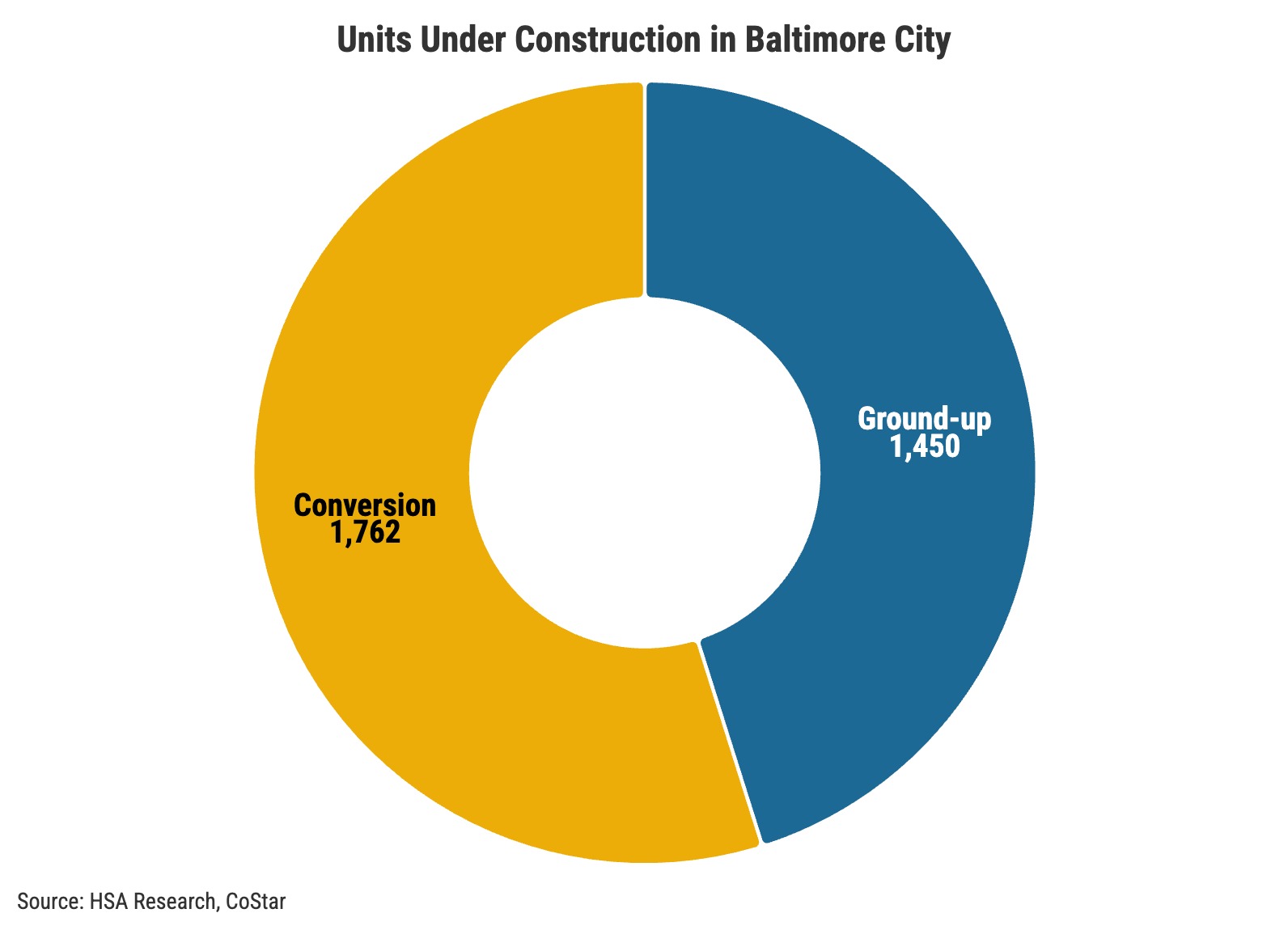

1,700+ Units = Total Units Under Construction Among Conversion Projects

An overall slowdown of office and hotel demand in the past years has presented several opportunities for apartment conversions. More than half of the construction pipeline in the city represents either an office, hotel, warehouse, or retail conversion, much of which is occurring in the downtown. Nearly 65% of the total units among conversion projects are located in the CBD.

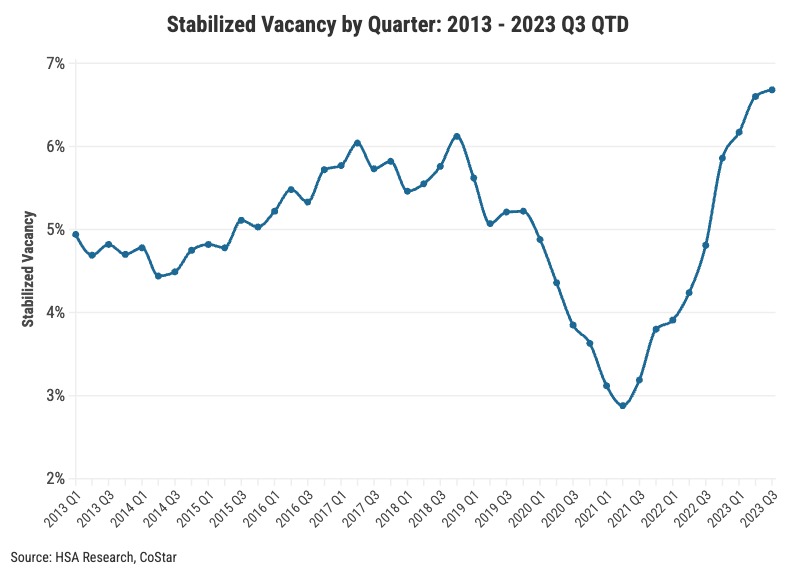

6.75% = Stabilized Vacancy Rate

Stabilized properties have vacancy rates of less than 7% and have started to decrease for the first time since 2021. Renter demand picked up over the summer months and could continue to increase in the near term as the single-family housing market has forced many households to continue to rent.