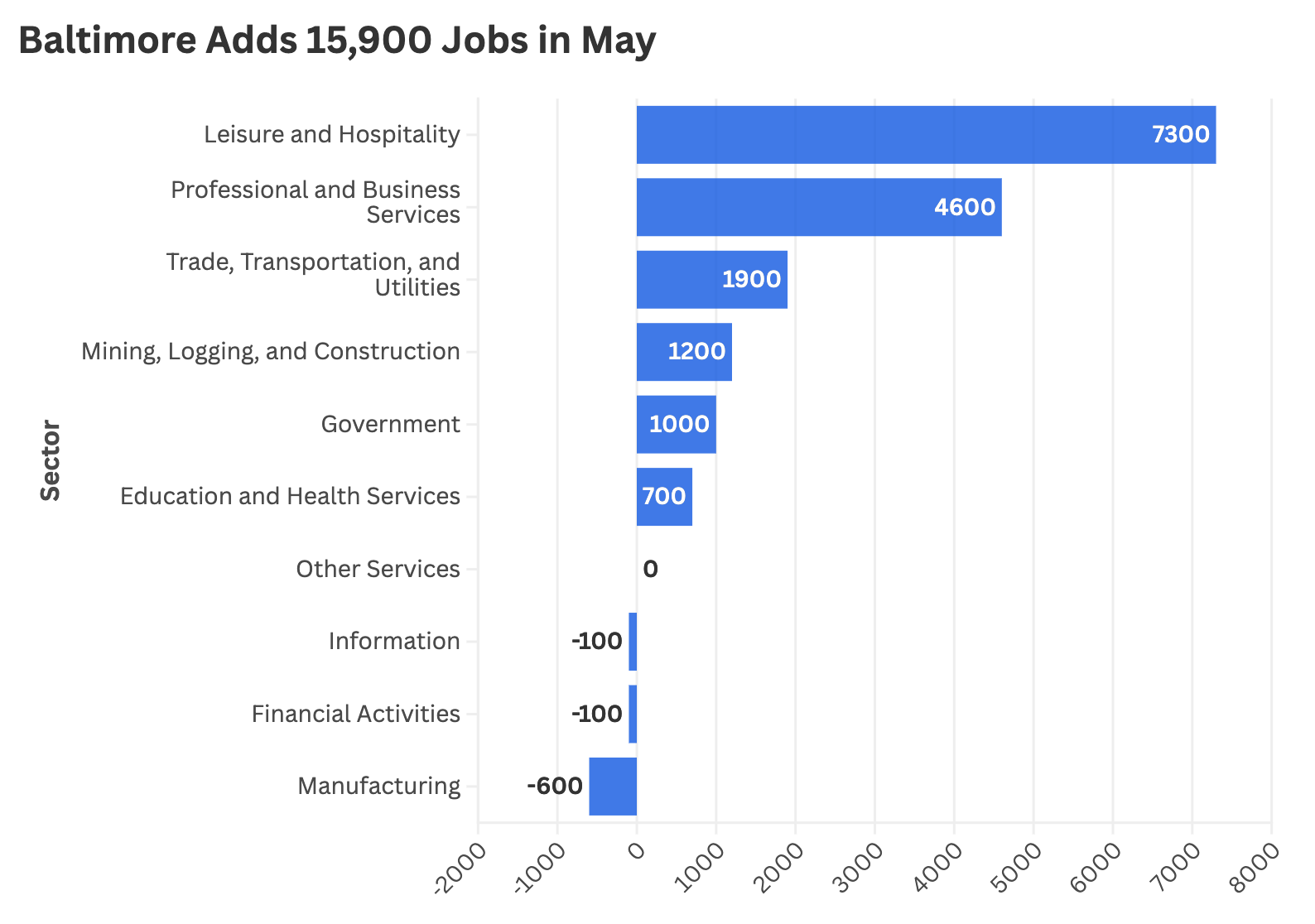

The Baltimore metro area is seeing sustained momentum in its multifamily housing market, driven by steady job creation and a slowdown in new apartment development. According to the latest data from the Bureau of Labor Statistics, the Baltimore MSA added 15,900 jobs in May 2025, bringing year-to-date gains to just under 40,000. These employment increases are supporting demand for apartments, even as new deliveries slow due to elevated interest rates and a decline in permitting activity.

Job Growth Anchored in Renter-Heavy Sectors

Baltimore’s labor market expansion is broad-based, but particularly robust in sectors that tend to support renter demand. Education and Health Services lead the pack with 9,200 jobs added over the past year, more than 60% of which were created in 2025. The sector is up 1.9% year-to-date and 3.2% year-over-year, reflecting the continued expansion of hospitals, universities, and medical centers across the region.

As the summer travel season ramps up, the Leisure and Hospitality sector has made a dramatic comeback, adding nearly 17,000 jobs this year, with more than half of those created in May alone. The sector’s 13% YTD growth underscores a strong recovery in tourism and the service-related employment, often tied to increased demand for rental housing.

Other sectors showing job gains this year include:

- Professional & Business Services: +8,000 YTD

- Government: +7,500 YTD

- Construction (Mining, Logging, and Construction): +4,300 YTD

Source: U.S. Census

New Supply Pulls Back, Asking Rents Climb

Elevated interest rates and conservative lending conditions have slowed construction starts, and permits for buildings with five or more units have been trending downward since early 2024. As a result, multifamily completions are expected to fall well below their 5-year average for the remainder of the year and likely into 2026.

This imbalance between steady demand and slowing supply is starting to manifest in leasing fundamentals. Baltimore has already seen a drop in vacancy rates this year, along with a nearly 2.0% rise in asking rents.

As long as job growth remains steady, multifamily conditions in the Baltimore MSA are likely to remain favorable for landlords throughout the rest of 2025, as new supply is expected to be limited.