The Baltimore Metro multifamily market has navigated a dynamic landscape in 2024, marked by elevated new deliveries, with more than 4,100 units entering the market. This wave of supply has tested the region’s resilience, but robust renter demand has allowed vacancy rates to stabilize. Rent growth is accelerating as a result, and year-over-year rental gains align with the growth in its Mid-Atlantic counterparts like D.C., Richmond, and Norfolk. The market is poised for continued recovery, with asking rents expected to rise steadily through 2025 and the next several years as the pace of new deliveries slows.

The Baltimore MSA saw elevated supply throughout 2024, but absorption, while strong at 3,170 units, was slightly outpaced by new inventory, contributing to an average vacancy rate of 7.2%. However, leasing momentum strengthened during the spring leasing months, accounting for nearly half of the units absorbed in 2024, allowing landlords to push rents.

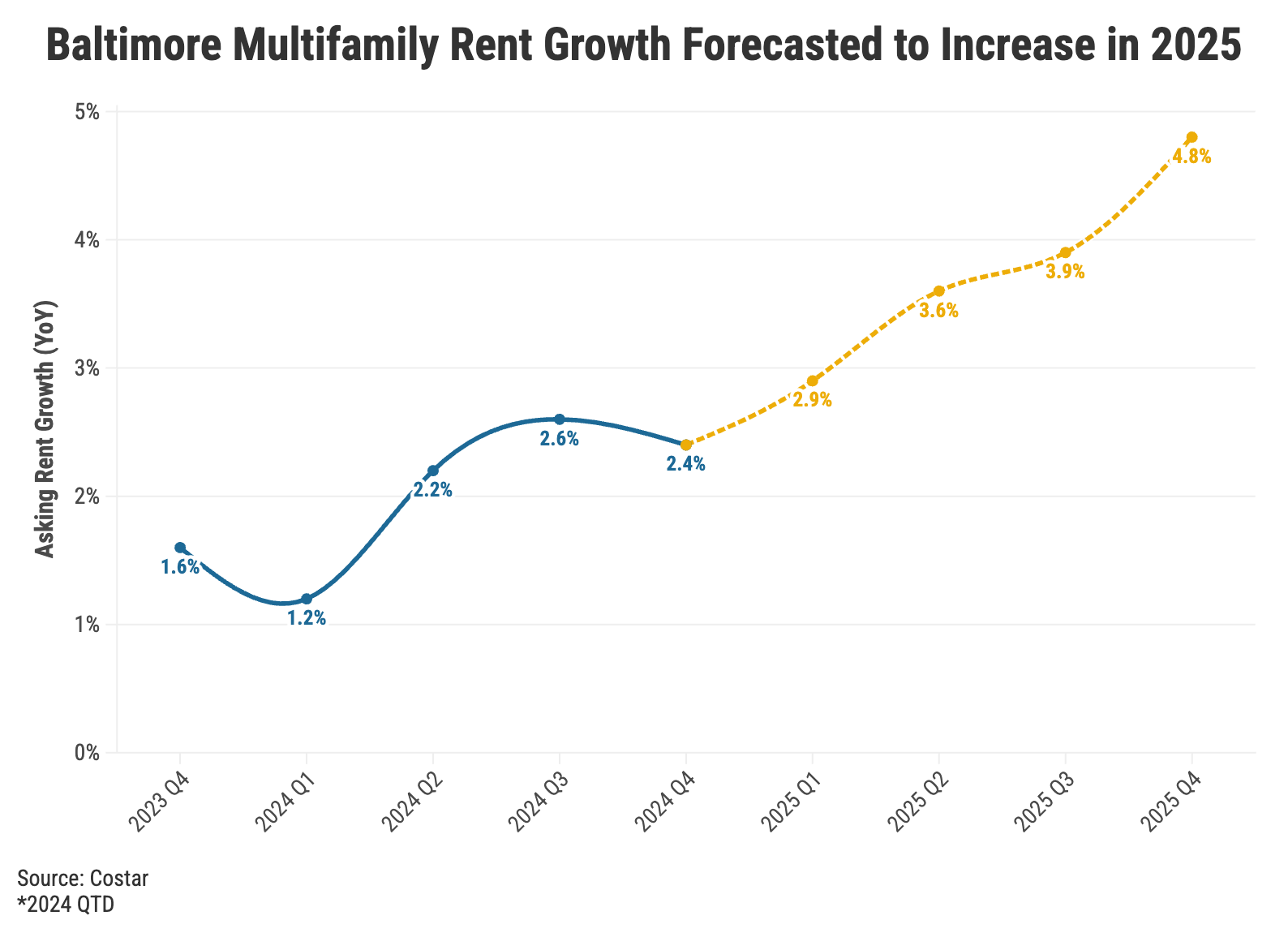

As of 2024 Q4, asking rents had grown by 2.4% year-to-date, reflecting improved pricing power for landlords. CoStar forecasts suggest rent growth will continue accelerating through 2025, reaching a peak of nearly 5% year-over-year.

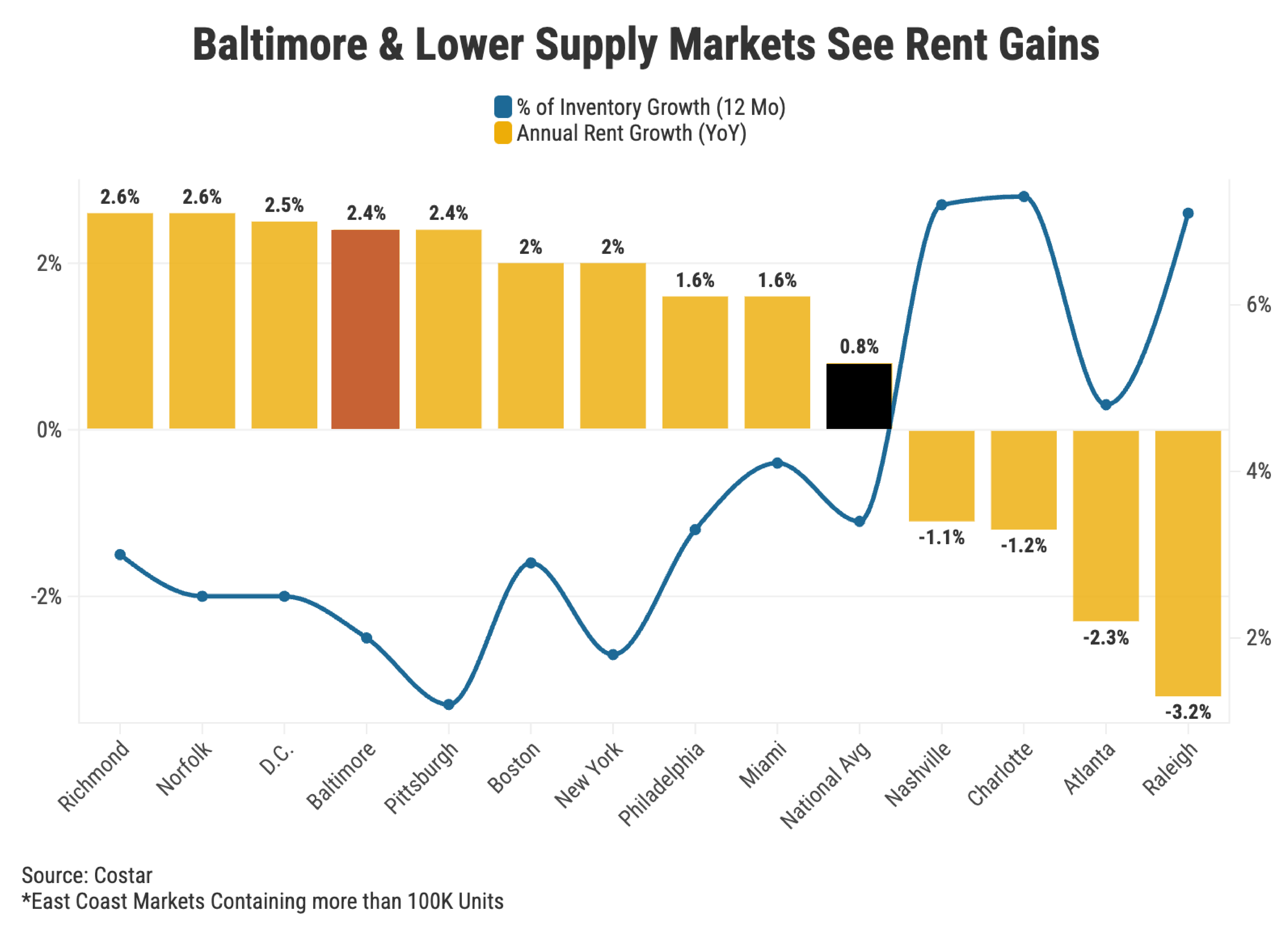

Compared to major markets, Baltimore stands out as one of the moderate-supply markets seeing steady rent growth in 2024, alongside other Mid-Atlantic metros. In contrast, many high-supply markets, particularly in the sunbelt region, are grappling with a surge in new construction, which has put downward pressure on rent growth.

Cities like Nashville, Charlotte, and Raleigh have seen inventory grow by over 7% in the last 12 months, leading to rent declines as landlords face increased competition to fill units. Baltimore’s position as a market with moderate supply growth has enabled it to avoid these challenges, with steady demand and limited new deliveries supporting rent growth.

One of the most striking trends in the Baltimore Metro multifamily market this year has been the robust renter demand, fueled by shifting housing preferences and the rising cost of homeownership. Nationally, homeownership costs have reached record highs, with mortgage rates hovering around 6.8% and median home prices remain at record levels. These dynamics have made renting a more attractive and affordable option for many households.

As a result, the Baltimore Metro is well-positioned to benefit from sustained demand, particularly in submarkets offering affordability and quality rental options. With strong renter demand, asking rent growth on the rise, and supply pressures beginning to ease, the region is well-positioned for a period of sustained recovery.