Key Takeaways:

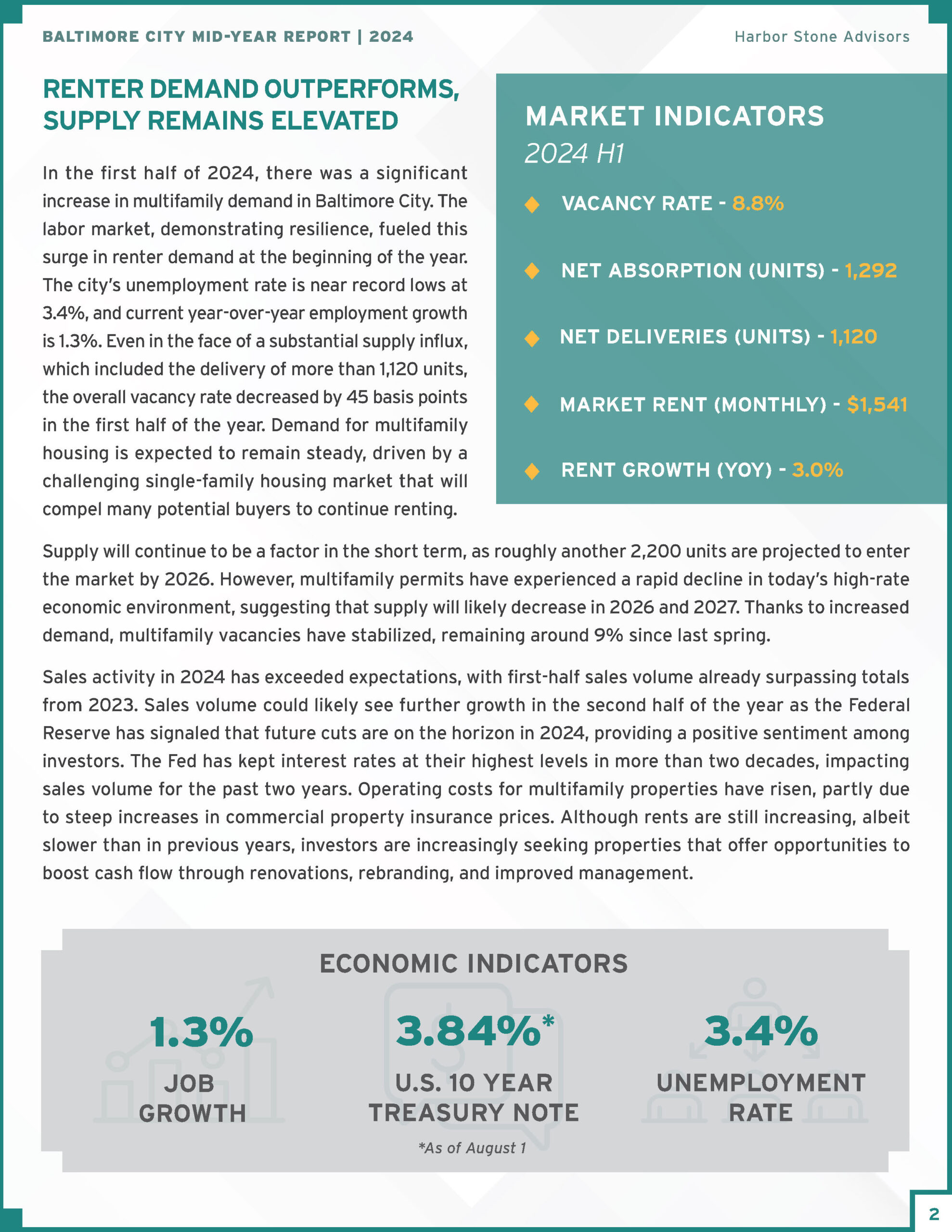

– In the first half of 2024, there was a significant increase in multifamily demand in Baltimore City. The labor market, demonstrating resilience, fueled this surge in renter demand at the beginning of the year. The city’s unemployment rate is near record lows at 3.8%, and current year-over-year employment growth is 1.3%

– Supply will continue to be a factor in the short term, as roughly another 2,200 units are projected to enter the market by 2026. However, multifamily permits have experienced a rapid decline in today’s high-rate economic environment, suggesting that supply will likely decrease in 2026 and 2027.

– In Baltimore City’s multifamily sales environment, a significant shift in the financing landscape is occurring and there has been a discernible trend towards alternative financing avenues such as hard money or short-term loans, debt assumptions, and cash purchases. This departure from conventional financing methods, like banks, signifies a response to the evolving economic dynamics of high interest rates.