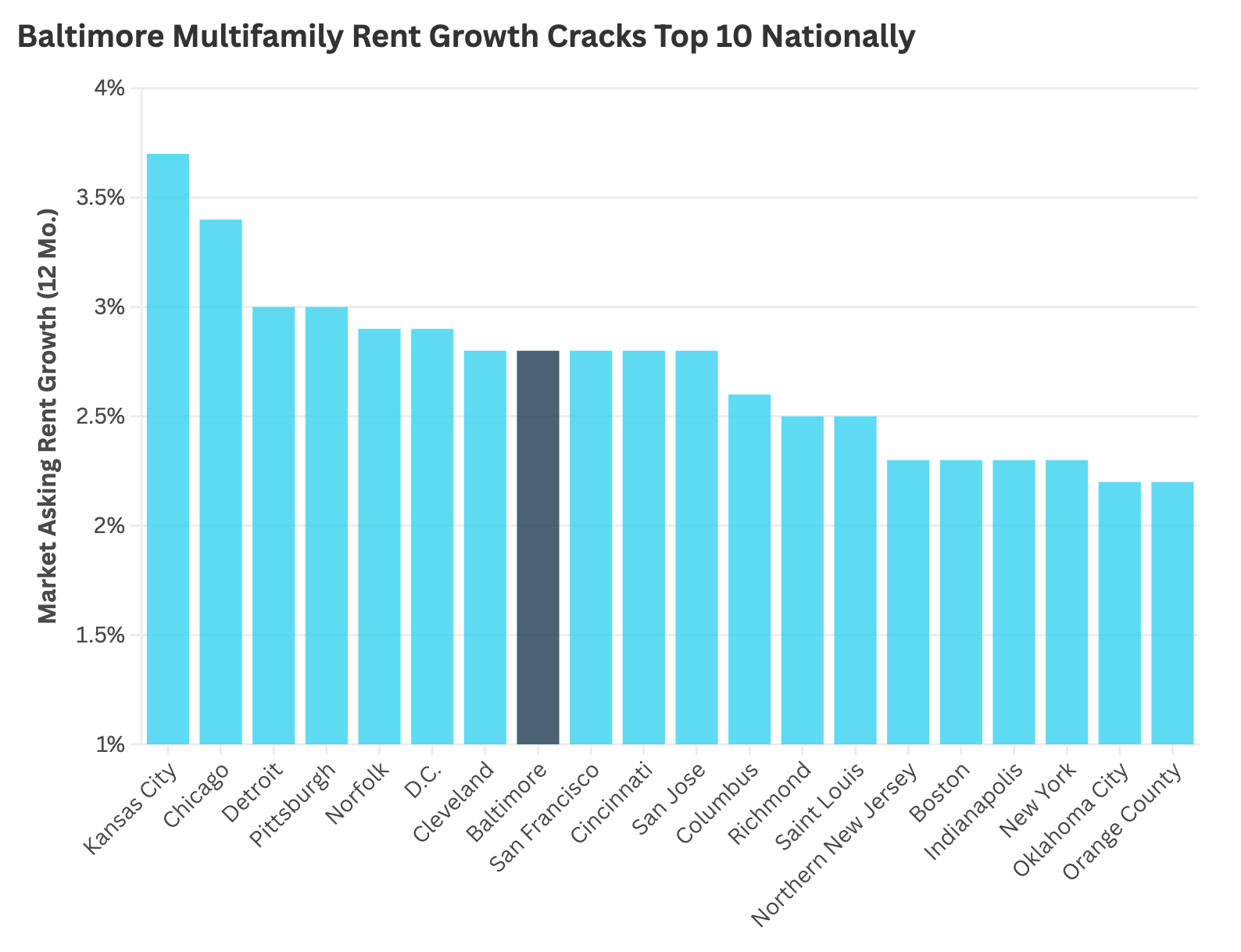

As apartment markets across the U.S. wrestle with elevated supply, Baltimore continues to post solid rent growth, outperforming many of its larger peers. Over the past year, Baltimore ranked in the top 10 nationally for multifamily rent growth, edging out major metros such as New York, Boston, and San Francisco.

According to CoStar, asking rents in Baltimore have increased by just under 3.0% year-over-year, compared to flat or declining rents in many Sun Belt and high-supply metros. Cities like Austin, Nashville, and Atlanta have seen rent decreases in recent quarters, driven by an influx of thousands of new units.

Baltimore’s positive rent performance reflects a disciplined supply pipeline, consistent demand, and a diverse economic base.

Source: CoStar

*End of 25Q1, Includes Metros with 100K+ Inventory

Baltimore’s Peak Supply Wave Has Passed

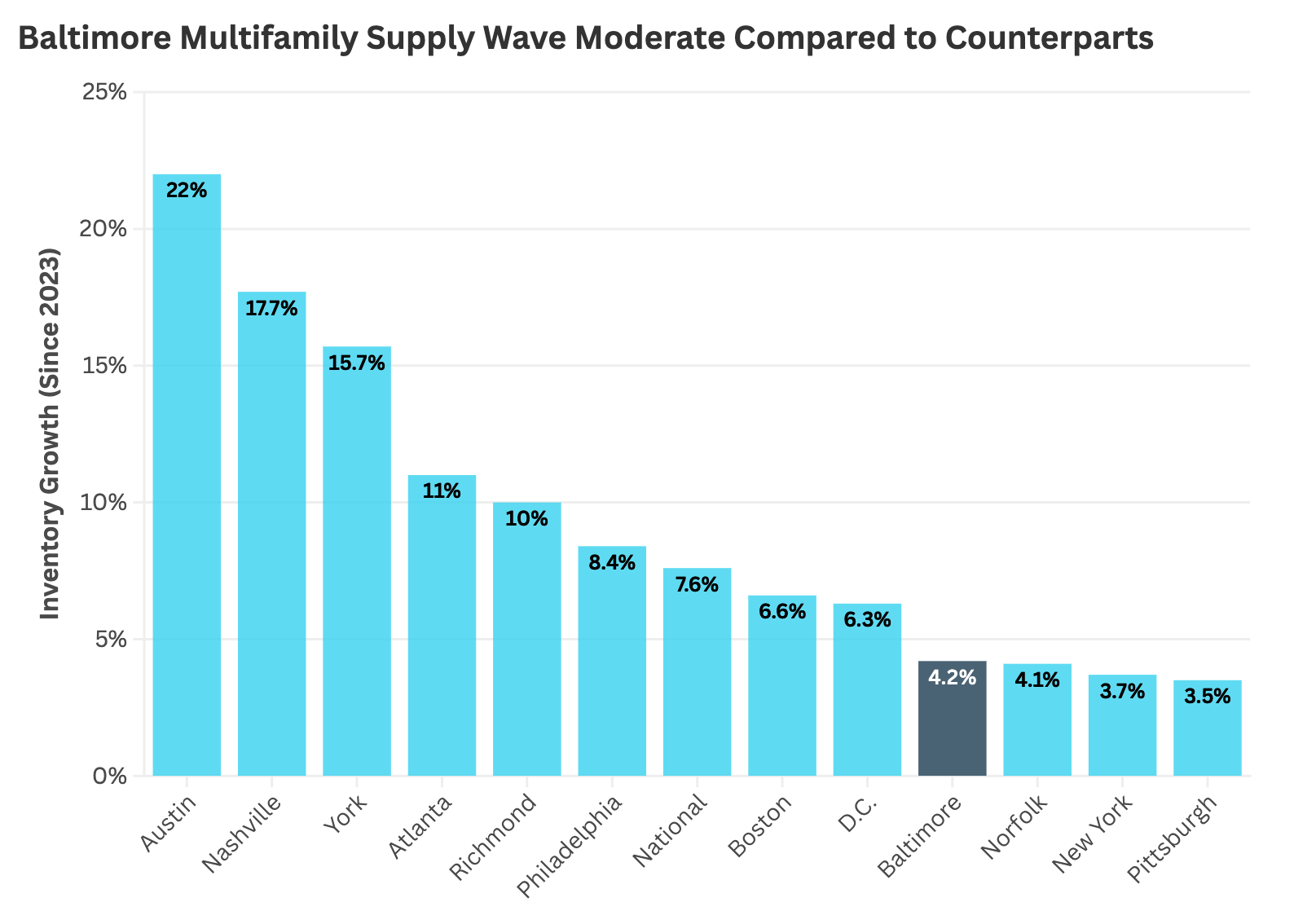

Baltimore experienced its largest apartment delivery wave in over twenty years between 2023 and 2024, with nearly 8,000 new units completed. While this marked a significant increase for the metro, the overall impact on the market has been more moderate than in many peer cities.

Since early 2023, Baltimore’s total multifamily inventory has grown by just 4.2%, placing it among the lowest growth rates of any major East Coast or Sun Belt market. By comparison, metros such as Austin, Nashville, and Atlanta expanded their apartment inventories by 22%, 18%, and 11%, respectively. Even mid-Atlantic markets, such as Philadelphia, Richmond, and Washington, D.C., posted inventory growth ranging from 6% to 11%.

Source: CoStar

This surge in development is largely driven by projects financed during the pandemic-era period of ultra-low interest rates. As these developments reached completion in the past two years, many metros, particularly in the Sun Belt, saw a flood of new inventory hit the market, pressuring rent growth and driving up vacancies.

With the peak delivery period in Baltimore’s rearview mirror, occupancies are trending downward for the first time since 2021 as the market works to absorb the recent surge in new supply. However, given the limited construction pipeline moving forward, Baltimore is expected to stabilize more quickly than high-growth markets where supply remains elevated.

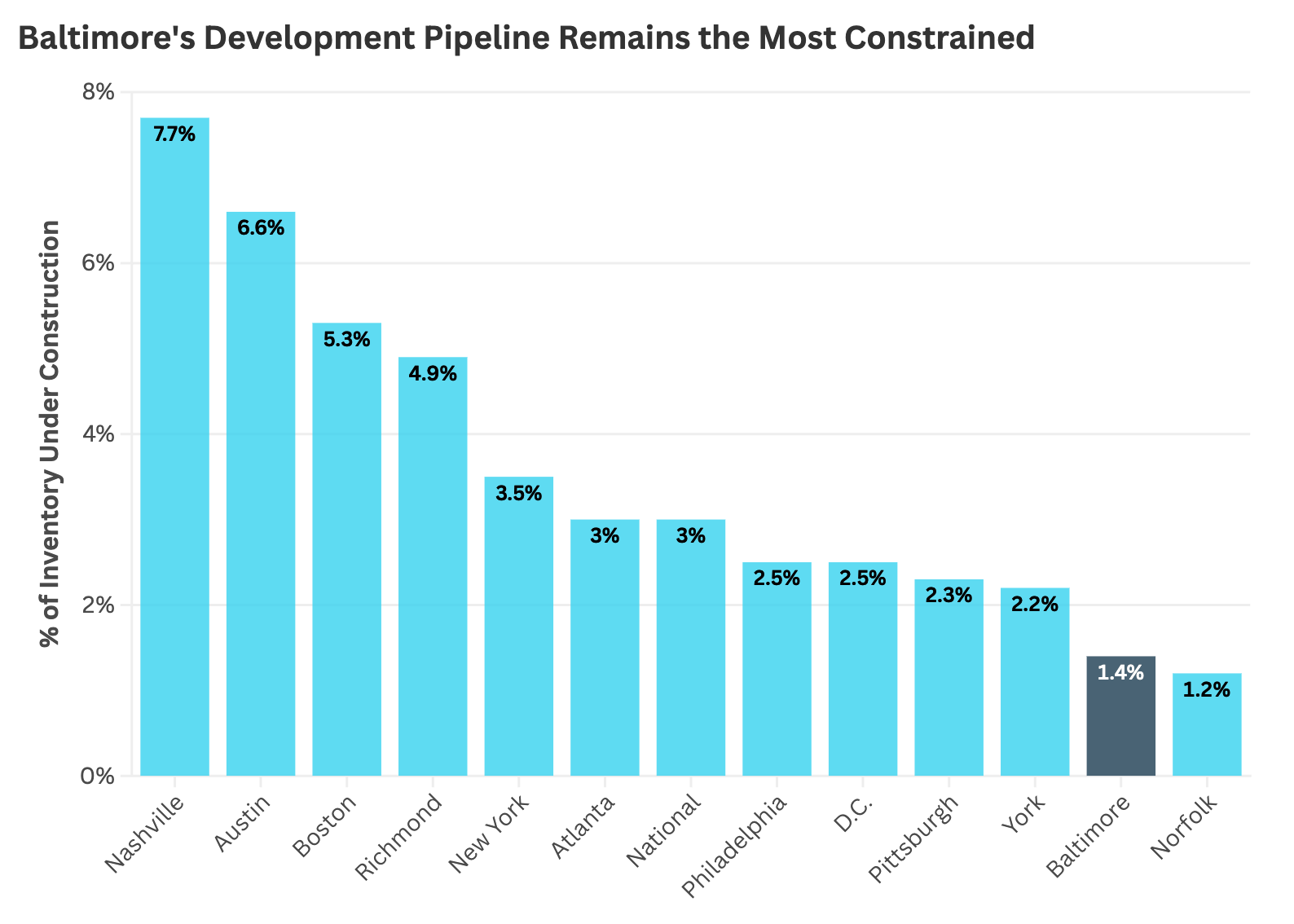

Multifamily Supply to Remain Minimal

As of 2025, Baltimore has just shy of 3,000 units under construction, representing only 1.4% of the existing inventory. This ranks among the lowest construction pipelines of any major U.S. market. In comparison, New York has nearly 56,000 units underway, representing 2.9% of inventory. Austin has over 21,000 units under construction (6.6% of inventory). Atlanta has over 16,000 units underway (4.7%), while Boston has roughly 15,000 units under construction (5.3%).

With its peak supply wave now completed and very little new product on the way, Baltimore is positioned to regain its occupancy footing and maintain rent stability more quickly than metros facing heavier ongoing deliveries.

Source: CoStar