The multifamily investment market in Baltimore is experiencing a resurgence in 2024, following a turbulent period brought on by rising interest rates. Harbor Stone Advisors has been at the forefront of this recovery, reporting a 95% year-over-year increase in deal activity*. President Justin Verner shares key insights into the factors driving this rebound and highlights where investors find the most opportunity.

Multifamily Sales Rolling Ahead: How We Got Here

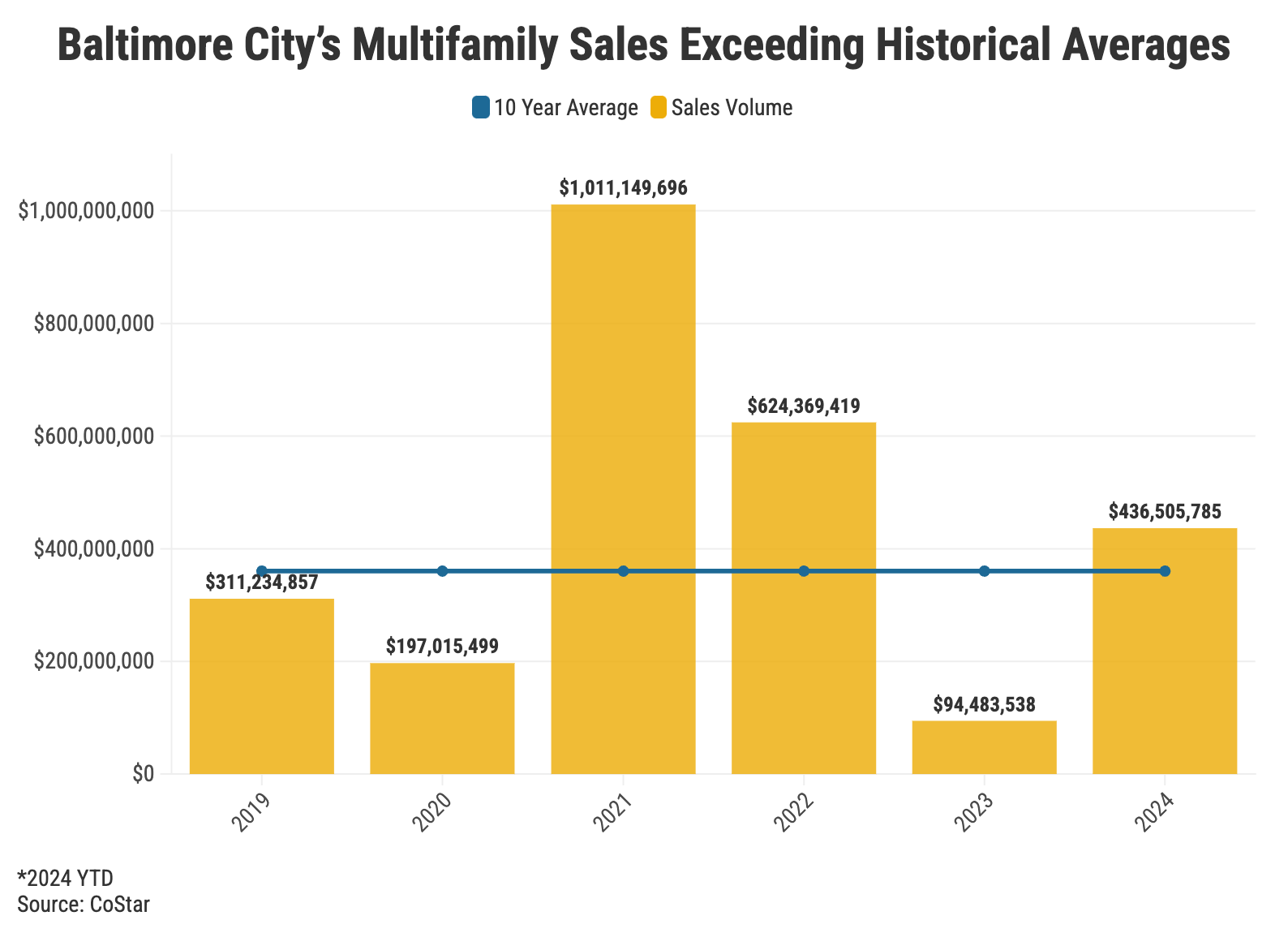

Multifamily sales are rising in 2024, reaching their third-highest level in the past decade. Baltimore City’s multifamily market’s total volume has exceeded $435 million in disclosed transactions. As more sales are expected to close before the end of the year, 2024 has shown an evident recovery from last year.

Historically low interest rates in 2021 and early 2022 marked a high point for multifamily investment sales, fueling aggressive offers and robust transaction volumes. However, the market shifted when rates began climbing sharply in late 2022. By 2023, multifamily sales activity had fallen to its lowest point in over a decade as many owners struggled to adjust to declining valuations.

“In late 2023 and into 2024, we’ve seen the bid/ask spread narrow significantly,” Verner notes. “Sellers have become more realistic about valuations, and buyers are gaining confidence that we’re now in a falling-rate environment.”

Investment Sweet Spots

Several trends are shaping investment activity in the Baltimore market:

Value-Add Opportunities Dominate

Value-add properties—those requiring capital improvements to achieve higher rents—have seen the most investor interest. These deals recently have often involved bridge loans or short-term financing, with buyers banking on future refinancing at lower rates. Sellers of value-add assets also tend to set more realistic pricing expectations than those of Class A properties, where rents are already at market levels.

“Value-add properties have been much easier to sell, as investors look for opportunities to create value and refinance at lower rates in the future,” Verner notes.

Suburban Markets Outperform

Suburban multifamily properties outside Baltimore City are attracting increased investor attention due to lower tax rates and fewer regulatory hurdles. For example, Prescott Square, a 77-unit garden apartment community in Pikesville, MD, sold in May 2024 after garnering 16 offers. Verner explains, “We’ve gotten more bids on suburban deals, and they tend to transact with more velocity compared to properties within the city.”

Evolving Financing Landscape

The sharp rise in interest rates over the past two years has reshaped the capital markets. Agency financing has become less common. “We saw a precipitous drop in buyers using agency financing over the past two years as rates have gone up significantly. And many balance sheet lenders and regional banks have pulled out of the market,” says Verner.

As these lenders have tightened regulations, investors have looked elsewhere for financing options. “We’ve seen a lot of life companies come in at lower leverage: 60%, 65% LTV. And we’ve seen a lot of bridge loans, hard money loans, debt assumptions, also some people purchasing in cash.”

The Road Ahead

The Federal Reserve’s decision to lower the federal funds rate is a promising sign for the multifamily market, though Verner emphasizes that its full impact has yet to be realized. “It’s going to take more time for the market to fully price in these changes,” he explains. Over the long term, lower rates could significantly reduce the cost of capital and further stimulate investment activity.

Baltimore’s multifamily investment market is navigating this transitional period with resilience, offering unique opportunities for investors willing to adapt to changing dynamics. As Verner observes, “We’re now in a period where buyers and sellers are more aligned, and the market is showing clear signs of recovery.”

*The original source reported a 75% increase, but recent data confirms the actual growth rate is 95%.