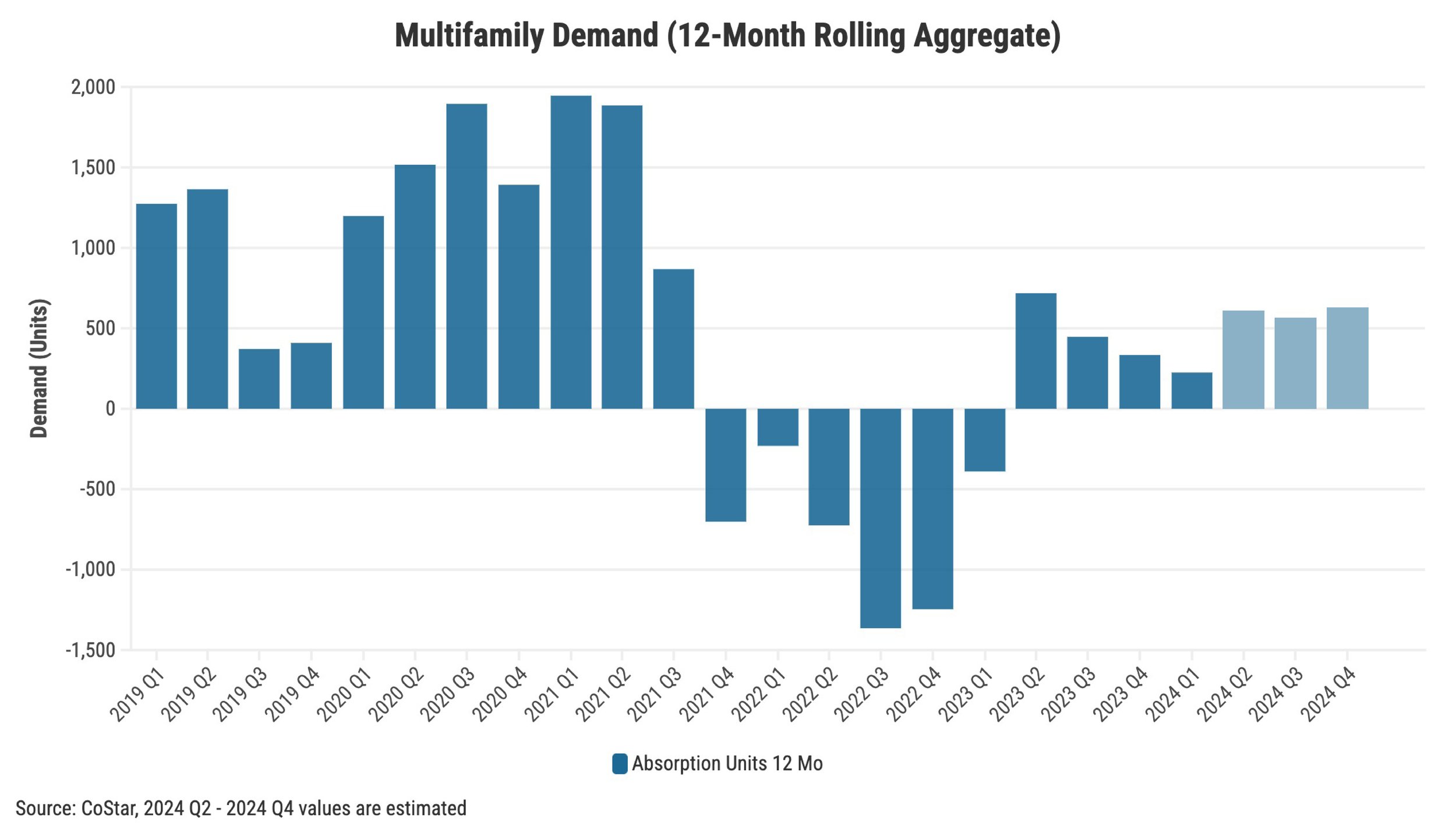

Since last spring, renter demand for multifamily properties in Baltimore has posted four straight quarters of positive absorption. Rising consumer sentiment and steady job growth have allowed many to return to the renting pool. Elevated rent growth in 2022 caused a long stretch of negative demand and forced many renters to look for alternative housing.

Several macro factors could also contribute to increased demand for apartments. The single-family housing market remains soft due to elevated mortgage rates and low inventory levels. This could make it more difficult for renters to purchase a home and add more demand. According to CoStar’s forecast, demand for multifamily housing will remain positive throughout the year and into 2025.

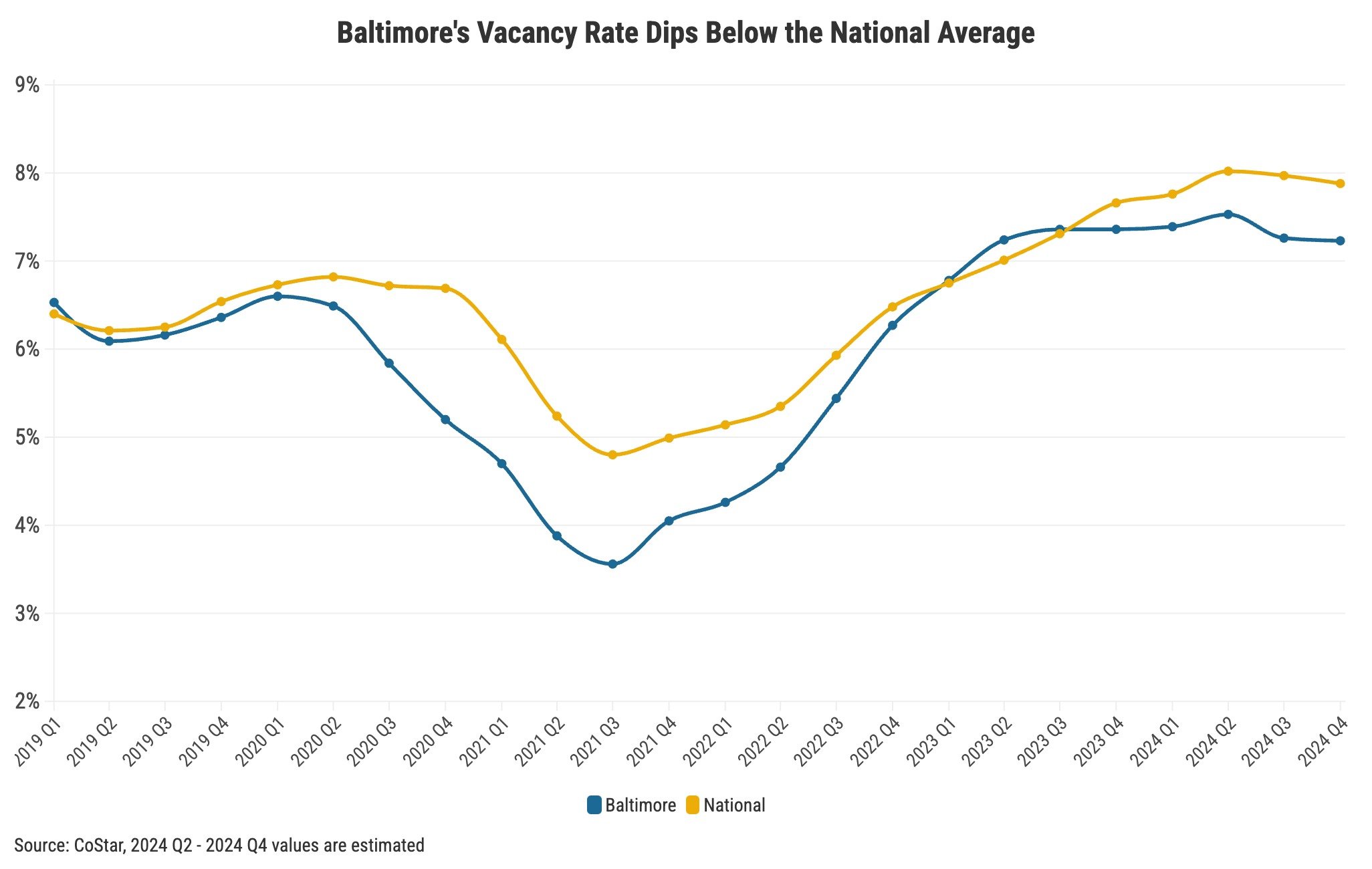

As demand for rentals increased, vacancies have stabilized and currently sit at 7.3%, just below the national average of 7.7%. Baltimore and its Mid-Atlantic counterparts have less supply underway than many of the Southern markets. This should favor Baltimore landlords as rents will likely grow as vacancies are forecasted to remain stable or slightly decrease, according to CoStar data.