Commercial property insurance prices have drastically increased across the country for the past several years. According to the Insurance Information Institute, premiums for commercial insurance at the end of 2022 increased by an average of 9.4%. Many insurance companies have referred to today’s market as the “hardest market” in decades.

A hard market typically results in higher premiums, tighter coverage terms, and greater difficulty obtaining coverage for some. A wide variety of factors has caused this rapid rise in cost recently, but experts have attributed three leading causes:

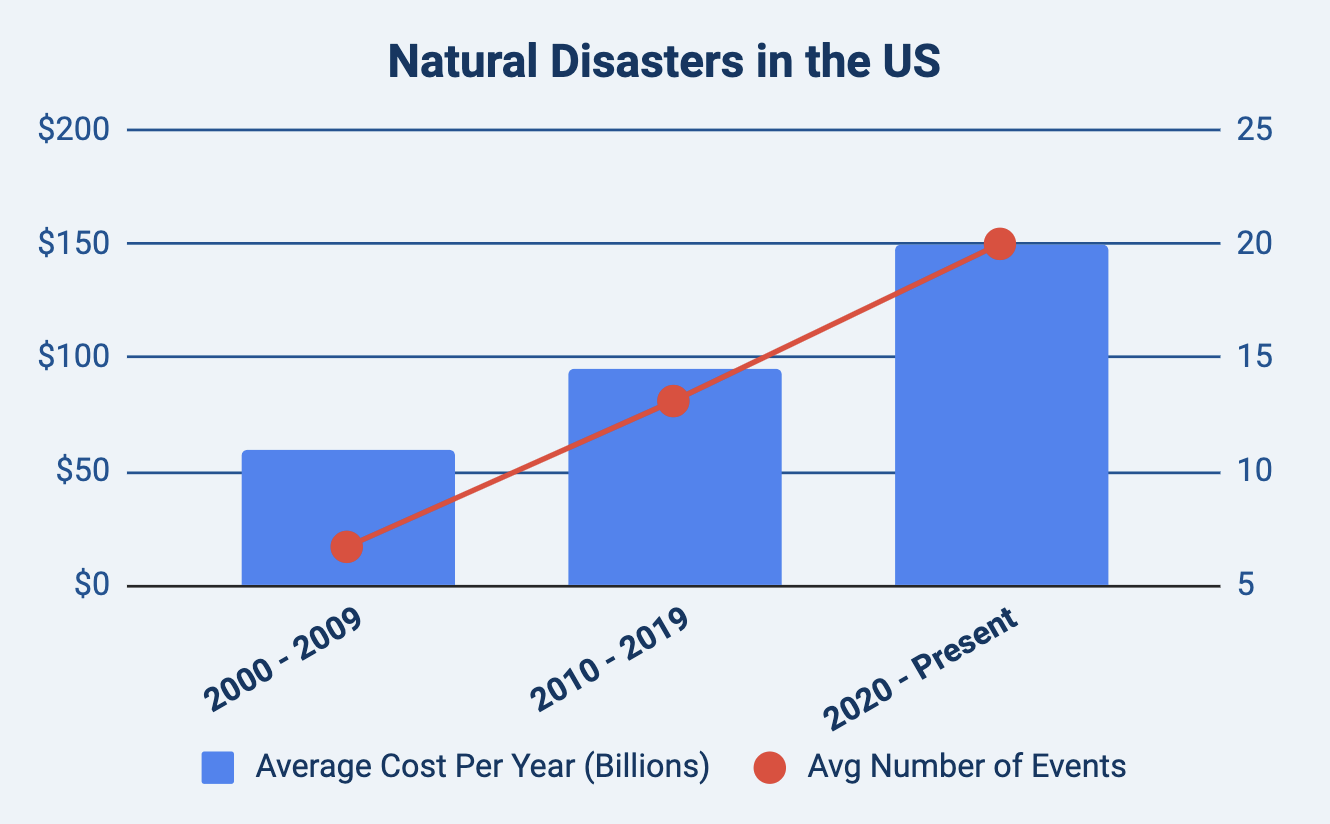

1. Natural Disaters

The number of natural disasters continues to impact all areas of the country at a rising rate. According to NOAA National Centers for Environmental Information, the number of natural disasters per year has increased to roughly 20 per year since 2020, compared to approximately 13 per year in the previous decade.

As the number of disasters increases, property insurance estimates are likely to continue to rise, especially in southern areas like Florida, Louisiana, and Texas. Last year was the third-highest year in total insurance cost.

Source: NOAA National Centers for Environmental Information

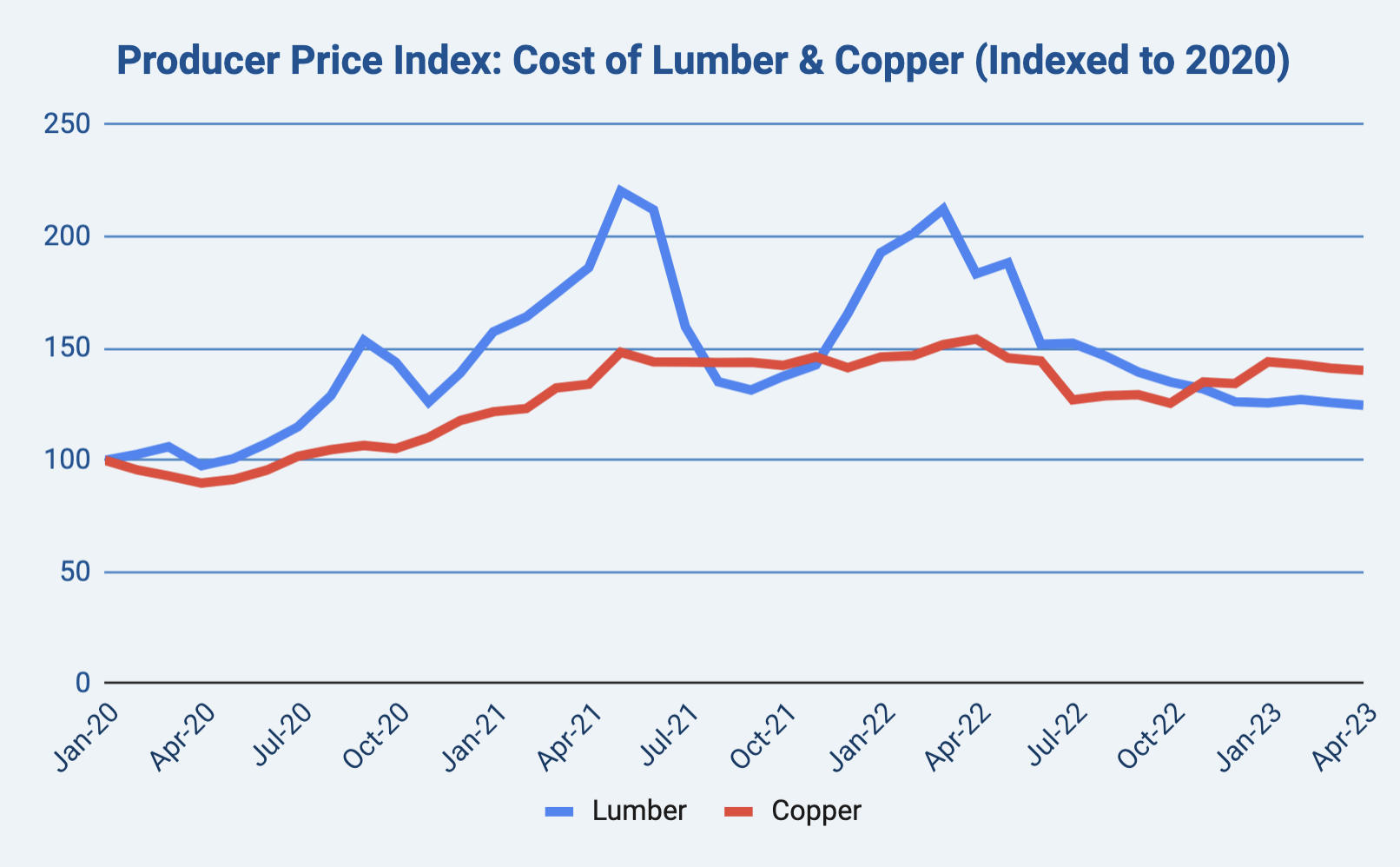

2. Higher Costs for Construction Materials

The supply chain disruption caused by the pandemic has resulted in elevated pricing for construction materials. Prices for lumber and other materials more than doubled within the first few months of the pandemic as demand slowed considerably. While the cost of materials like lumber has fallen since its peak in April 2021 and April 2022, the rapid fluctuation in pricing makes it difficult for insurance companies to estimate future pricing effectively for underwriting purposes.

Source: U.S. Bureau of Labor Statistics

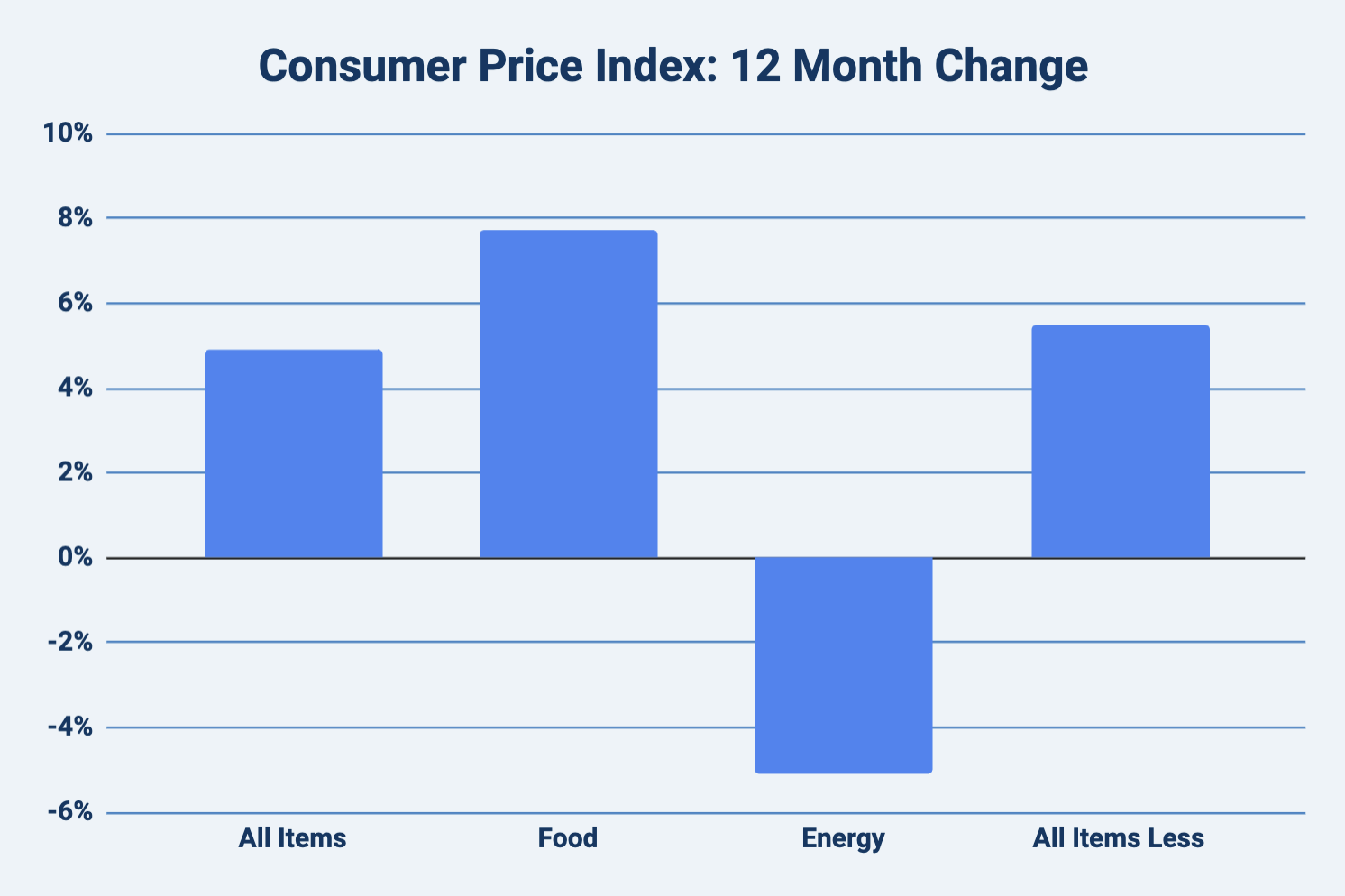

3. Inflation

To combat historical inflation, the Federal Reserve raised rates for the 10th time in a little over a year in early May, pushing the fed funds rate to a target range of 5%-5.25%. Inflation has resulted in challenges for the property insurance market, as replacement costs have skyrocketed due to the increase in the price of labor and materials.

Source: U.S. Bureau of Labor Statistics