Baltimore City Multifamily Investment Report: June 2023

Key Takeaways

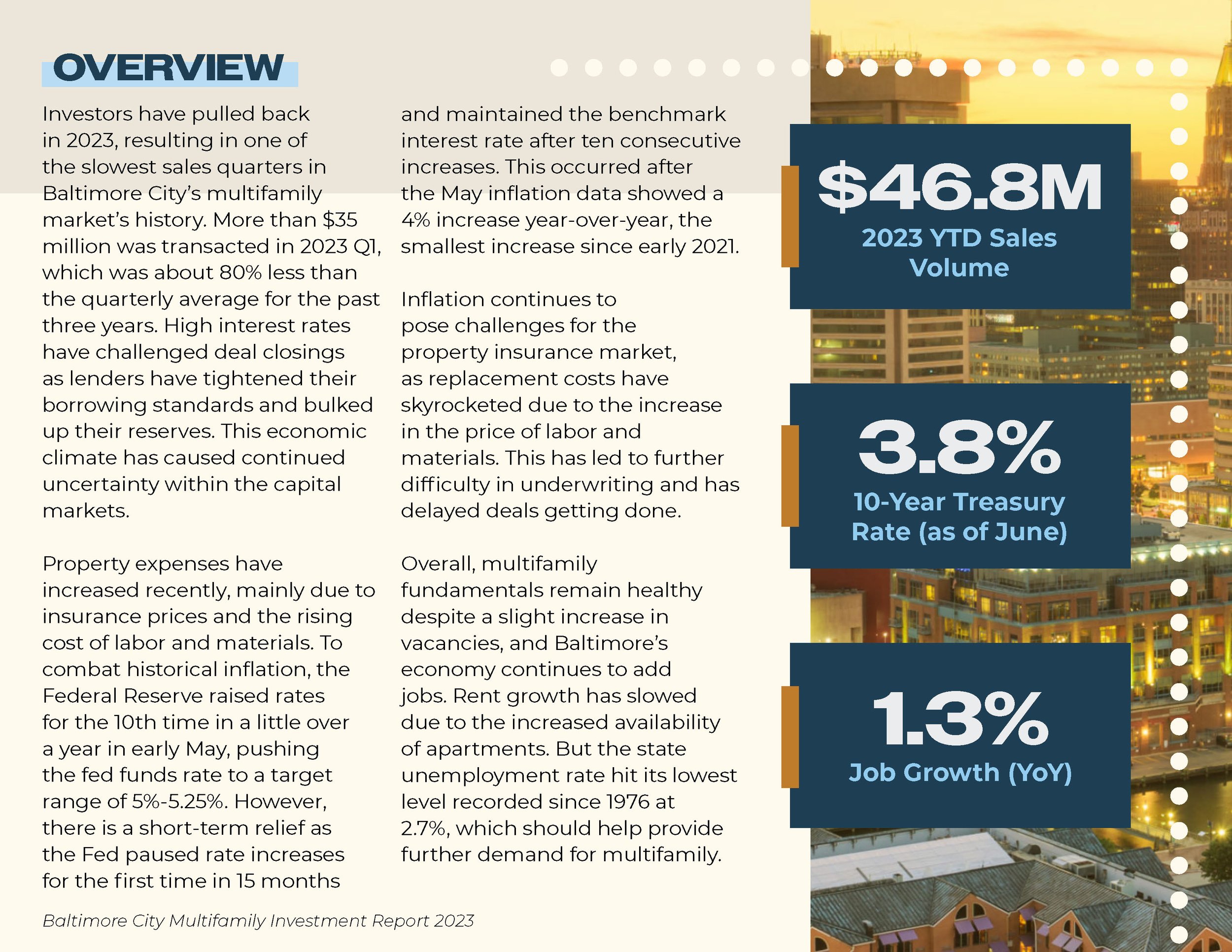

Investors have pulled back in 2023, resulting in one of the slowest sales quarters in Baltimore City’s multifamily market’s history. More than $35 million was transacted in 2023 Q1, which was about 80% less than the quarterly average for the past three years. High interest rates have challenged deal closings as lenders have tightened their borrowing standards and bulked up their reserves. This economic climate has caused continued uncertainty within the capital markets.

Cap rates have begun to increase in recent quarters and “appear to be reflecting past market conditions that have changed significantly over recent months,” according to the Mortgage Bankers Association (MBA). The MBA’s forecast for the near term includes a slight expansion as the market adjusts to the Federal Reserve’s stringent monetary policy.

The Federal Reserve paused rate hikes for the first time in 15 months at the Central Bank’s June meeting after ten consecutive increases. This comes after the U.S. Bureau of Labor Statistics May release of the Consumer Price Index of a 4% increase year-over-year, the smallest rise since the beginning of 2021. Though the Fed committee suggested, there would likely be further hikes.