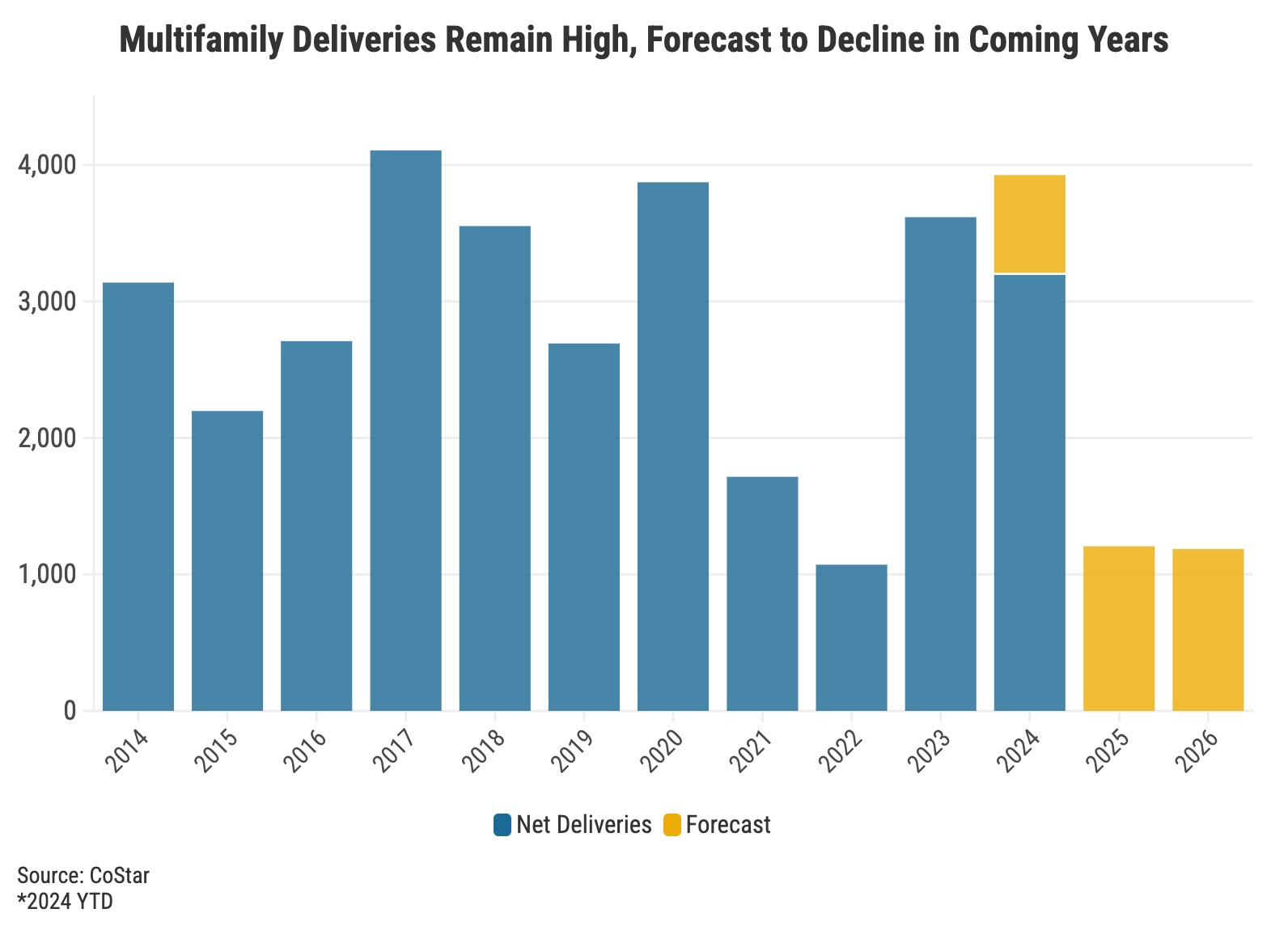

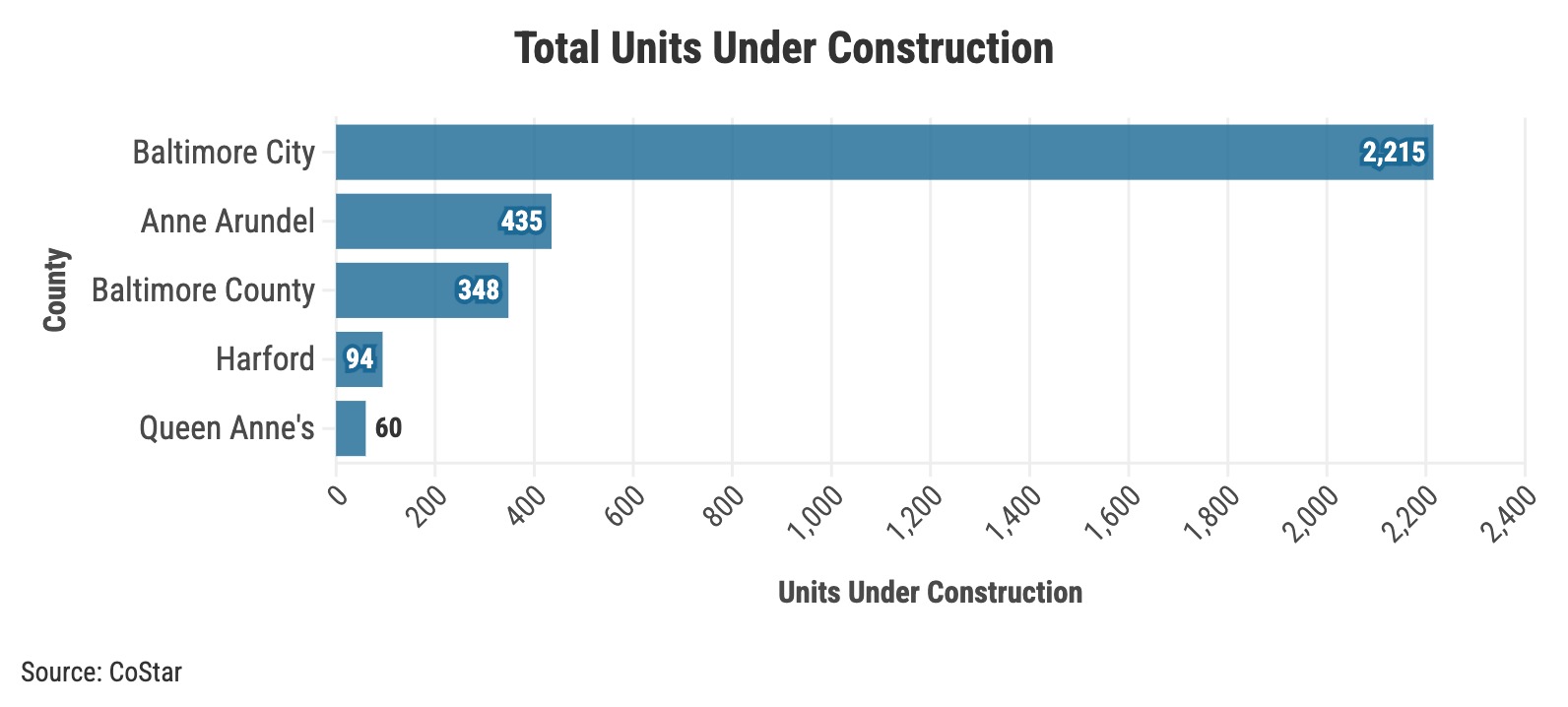

Several large multifamily projects initiated during the pandemic’s low interest rates are now completed, contributing to sustained high levels of apartment deliveries last year and throughout 2024. Over 3,200 new units have been delivered this year, with 2,500 coming online in the first half of the year. In the Baltimore Metro, there are currently 2,800 units under construction, or 1.3% of its total inventory, well below the national average of 4.1%. However, the current shortage of permitted multifamily units suggests a potential impact on total deliveries in the coming years.

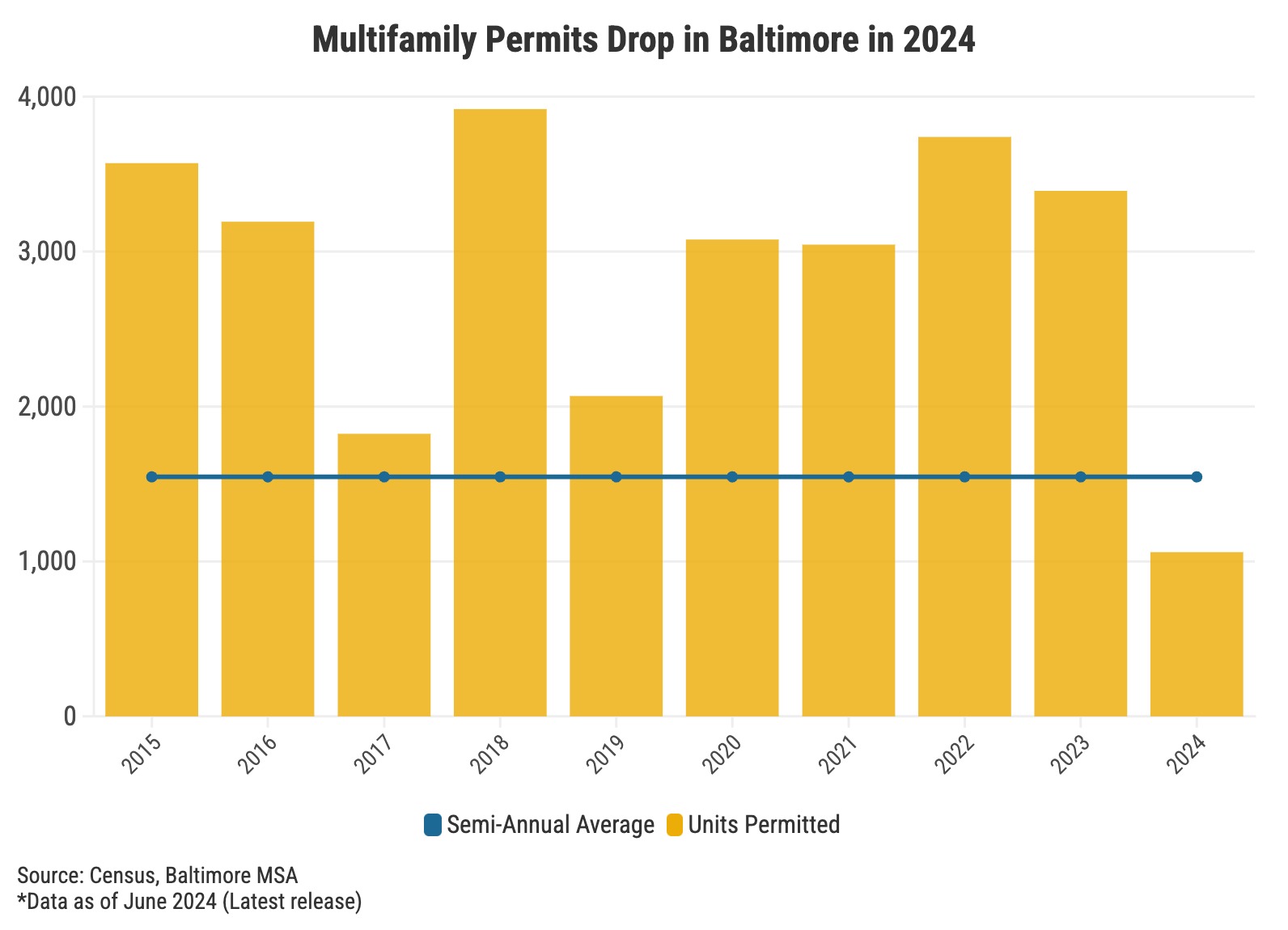

Baltimore’s multifamily permitting activity of 5 or more units experienced a notable decline during the first half of 2024, with 1,060 units permitted, marking a 40% decrease compared to the 10-year semi-annual average. This downturn can be attributed to stringent lending conditions and elevated interest rates, which have impeded the progression of development proposals.

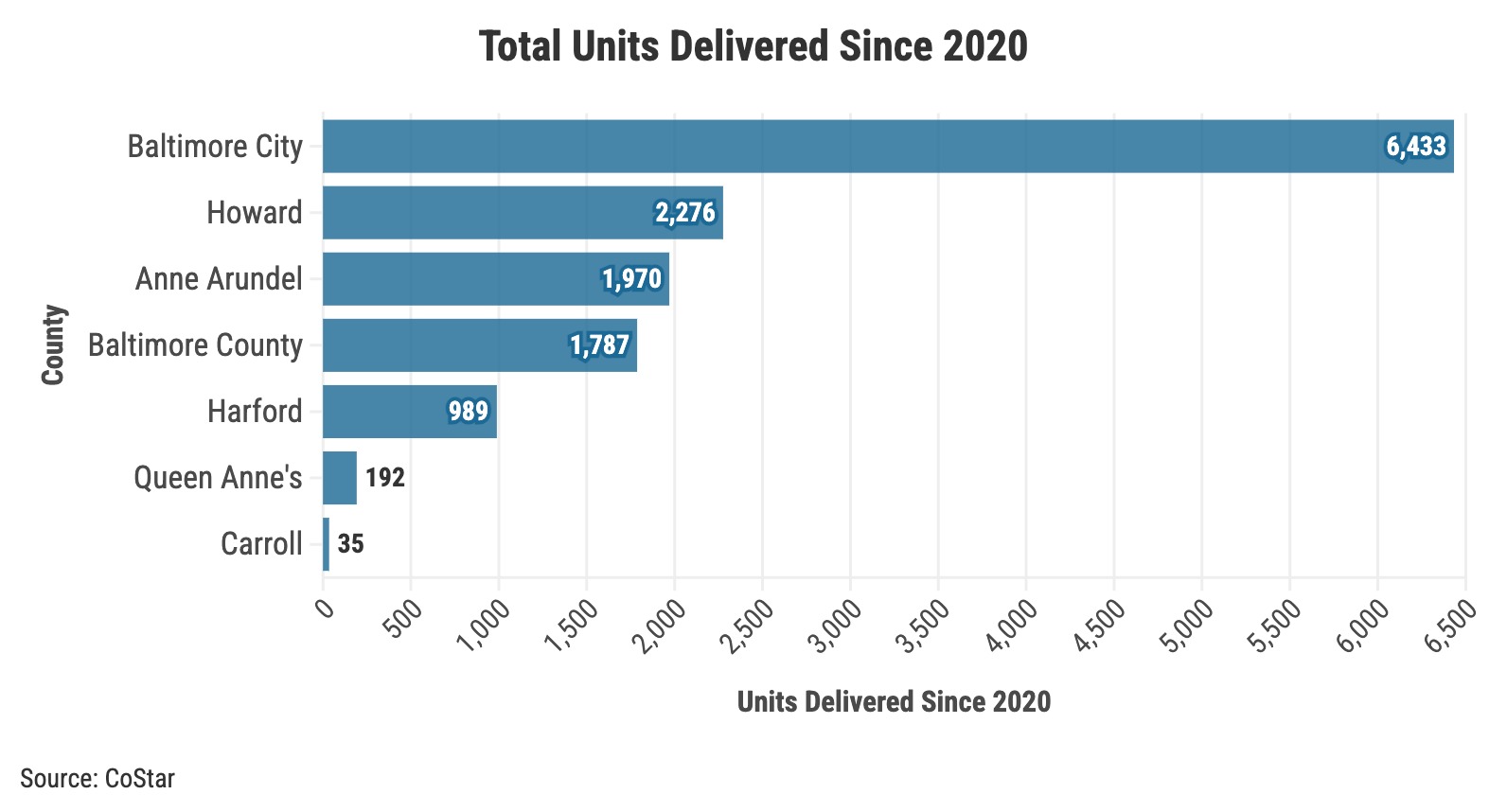

Baltimore has experienced a substantial supply influx in the past two years, with more than 3,300 units delivered, a 3.1% increase in its overall inventory. Much of the current apartment development has been and is currently still focused within the Baltimore City limits, representing 50% of the units delivered during that time.

Fells Point and Downtown have recently been the target areas of development, with a focus on converting former retail, office, and hotel properties to apartments. Demand for office space in Baltimore’s downtown has slowed as many firms look towards Harbor East or have adapted remote work, requiring less office space.

As a result, office vacancy rates in Downtown Baltimore have increased significantly, opening opportunities for office conversions. One example is 1 Calvert Plaza, which is currently undergoing major renovations to convert the historic office building to 173 high-end units. Chasen Companies, one of Baltimore’s premier apartment developers, purchased the property in 2022 for $11.1 million.

As demand for hotels dropped during the pandemic, many low-performing properties are being converted to apartments. Recent hotel conversions include the former dual-branded Radisson and Holiday Inn, located at 101 and 105 West Fayette Street, which will be converted to 708 multifamily units, and the former Embassy Suites Inner Harbor hotel, purchased by Urban Investment Partners Cos. for $18 million, which will convert the hotel to 306 units.

Outside of Baltimore City, apartment development has steadily increased in Howard County, and total inventory here has increased by more than 15% in the past five years. Much of the focus is within Columbia and Maple Lawn, which are areas that have seen increased job creation and population. Other counties to see substantial growth are Anne Arundel and Baltimore County, two desirable areas for families with a plethora of job opportunities.

In Baltimore County, apartment projects will become harder to complete over the next several years. In June 2024, the council passed a bill to prevent new housing developments from being built in overcrowded school districts. The bill limits overcrowding from 115% to 105% while also allowing the county to build federally required affordable housing units. It also eliminates an adjacency rule, which said students could be placed in neighboring districts if theirs was overcrowded.

Overall, Baltimore’s construction pipeline will likely have minimal impact on vacancies, especially as demand has outperformed in 2024. This minimal supply-side pressure should continue to benefit landlords’ ability to push rents.

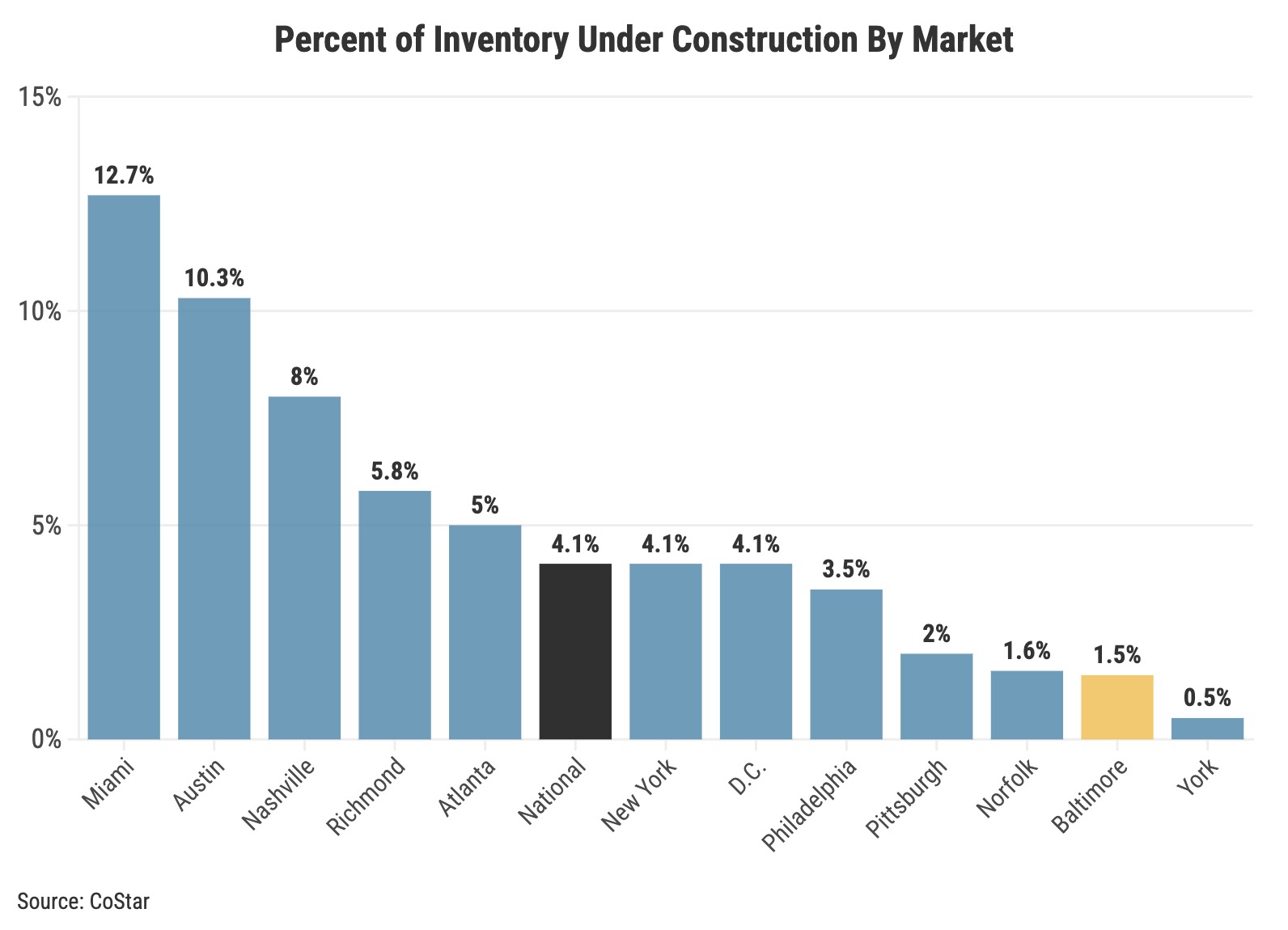

The Baltimore MSA apartment development pipeline remains below the national average, with 2,800 units under construction, or 1.3% of its total inventory. This is below many of its neighboring cities like D.C., Richmond, and Norfolk and is about a third of the national average in terms of percent of total inventory underway.

Multifamily development is currently the highest in many sunbelt markets like Miami, Nashville, and Austin, where population and job growth are robust. Baltimore’s development pipeline is tamer, which has helped keep vacancies low and rent growth steady.

Cover image Credit: Hord Coplan Macht