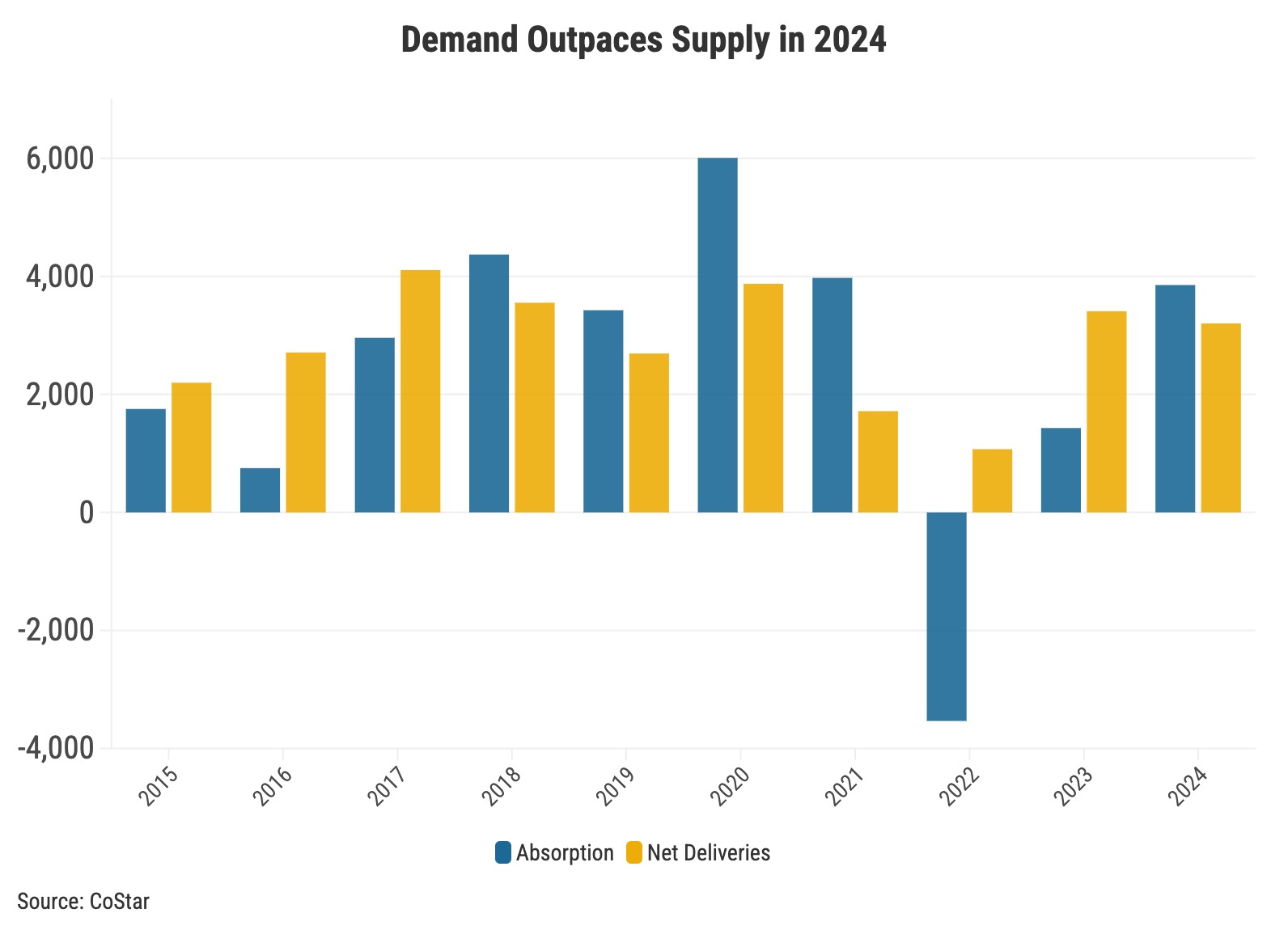

The Baltimore MSA multifamily market has experienced a surge in renter demand in 2024, with a notably strong second quarter. First-half absorption totaled 2,574 units, the sixth highest since 2000. This high absorption is driven by increased consumer confidence, leading to more significant household formation, ample supply, and fewer renters transitioning to homeownership due to a challenging economic environment.

*2024 YTD

*2024 YTD

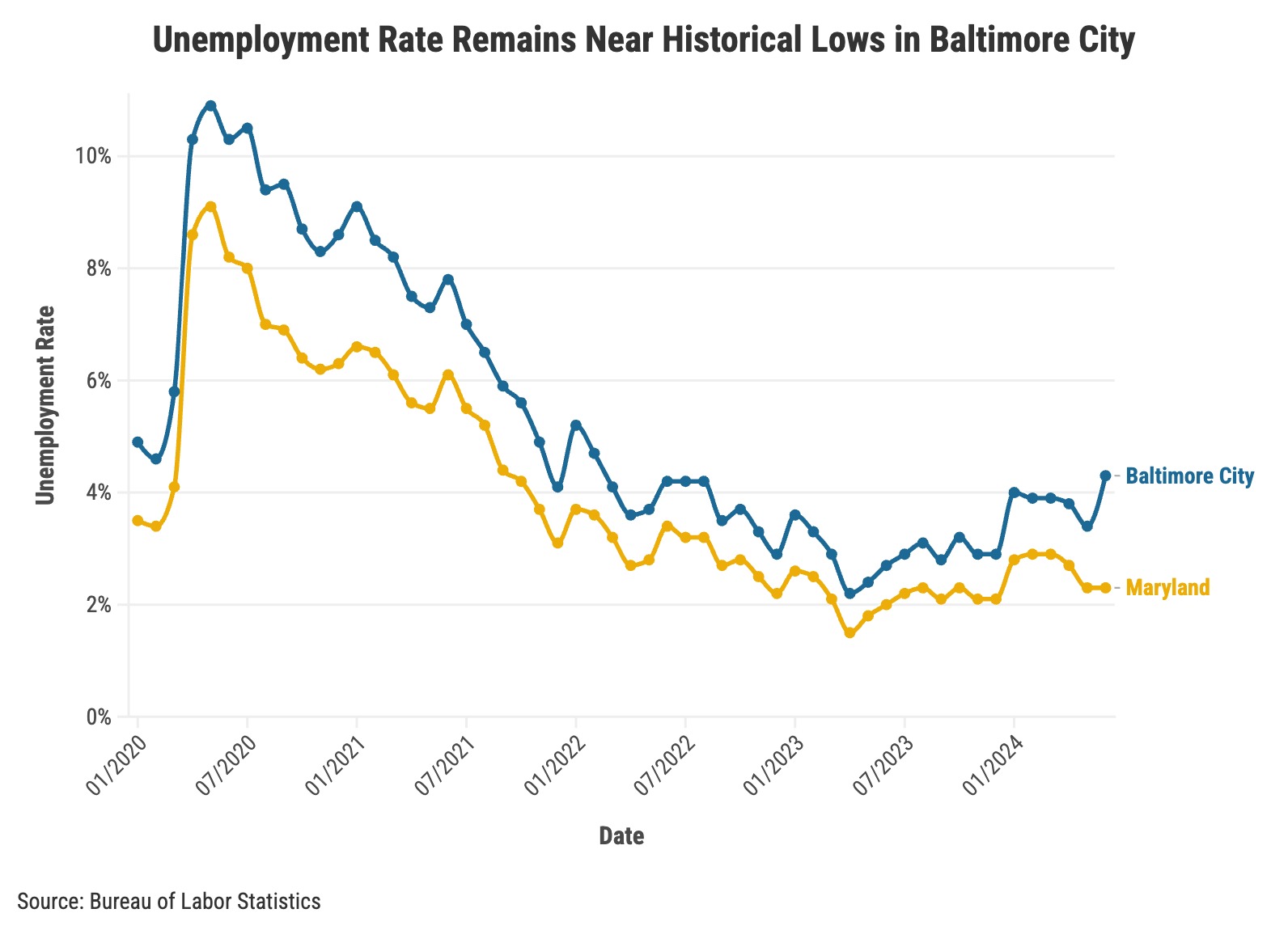

Continued job and wage growth and increased consumer confidence have fueled an upward trend in household formation. Household formation occurs when individuals establish separate living arrangements, such as young adults leaving their parents’ homes, couples getting married or cohabitating, or individuals getting divorced and living separately. More households are forming compared to 2022 and 2023, which were years of peak consumer inflation.

The persistent strength of the labor market has led to near-historically low unemployment rates in Baltimore City and Maryland. Despite a marginal increase in 2024, unemployment in the city hovers nearly 100 basis points below the average since 2000. The aforementioned demographic changes in household formation, alongside baby boomer retirements, have contributed to maintaining tight conditions in the job market.

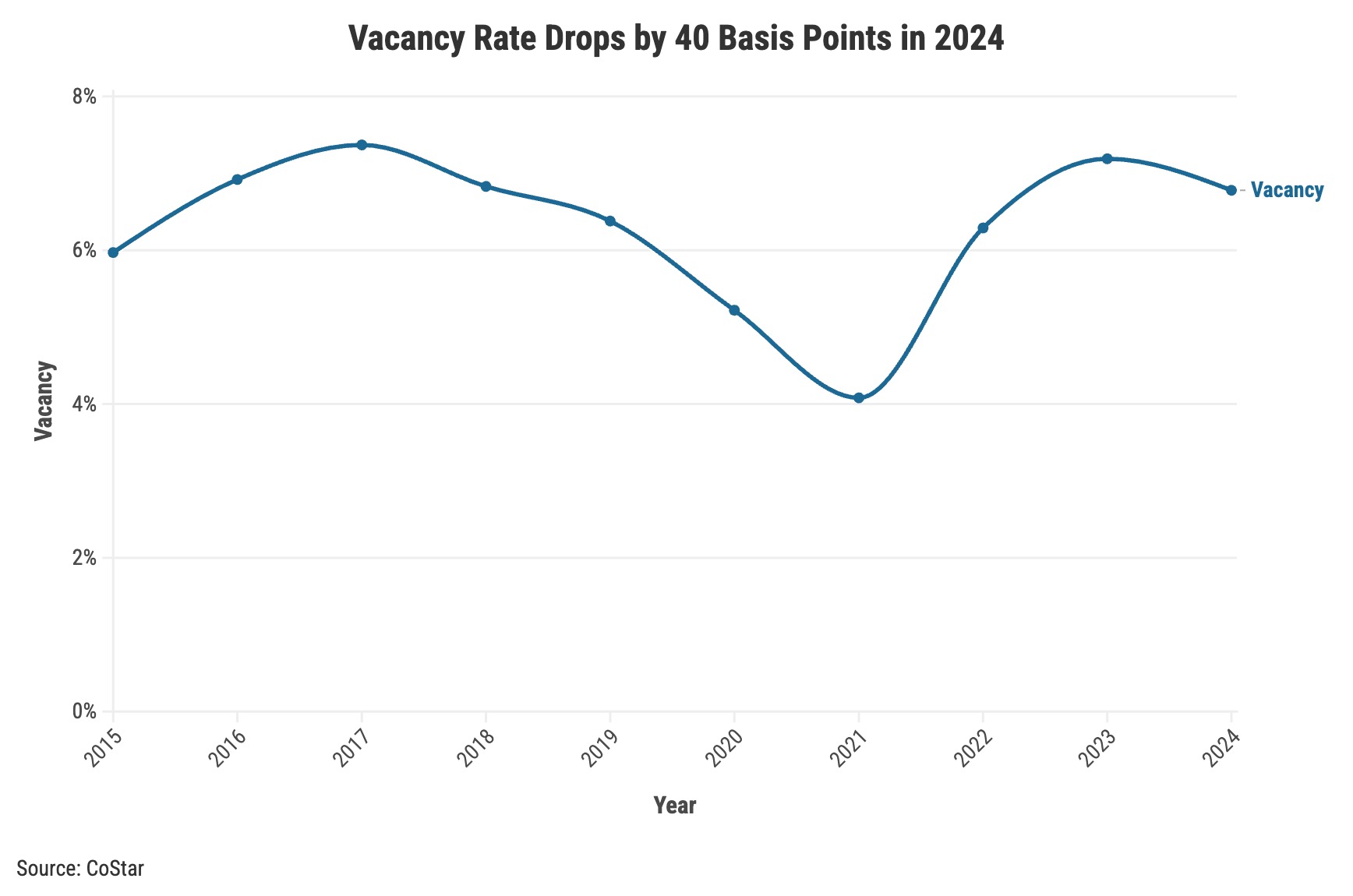

High levels of multifamily supply in Baltimore have made more units available, prompting landlords to offer concessions to attract renters. Over 2,650 new units have been delivered in 2024, with 2,300 coming online in the first half of the year. This influx of new units has led landlords to offer incentives like up to two months of free rent. As demand outpaces this increased supply, overall absorption has risen.

Another factor contributing to increased absorption is the single-family market. Homeownership has remained challenging to achieve for many as mortgage rates stay high. Single-family housing prices in the Baltimore MSA have increased more than 30% since the pandemic began, making affordability a significant concern. With elevated prices and high capital costs, buyer demand for single-family homes has decreased. Consequently, fewer households move out to buy houses, leading to higher total absorption as net absorption equals move-ins minus move-outs.

Overall, the Baltimore MSA multifamily market is witnessing robust demand in 2024, driven by economic factors that favor renting over homeownership. Increased consumer confidence, significant new supply, and barriers to entering the single-family housing market have all contributed to high absorption rates. As the year progresses, monitoring these trends to understand their long-term impact on the region’s market dynamics and housing affordability will be essential.