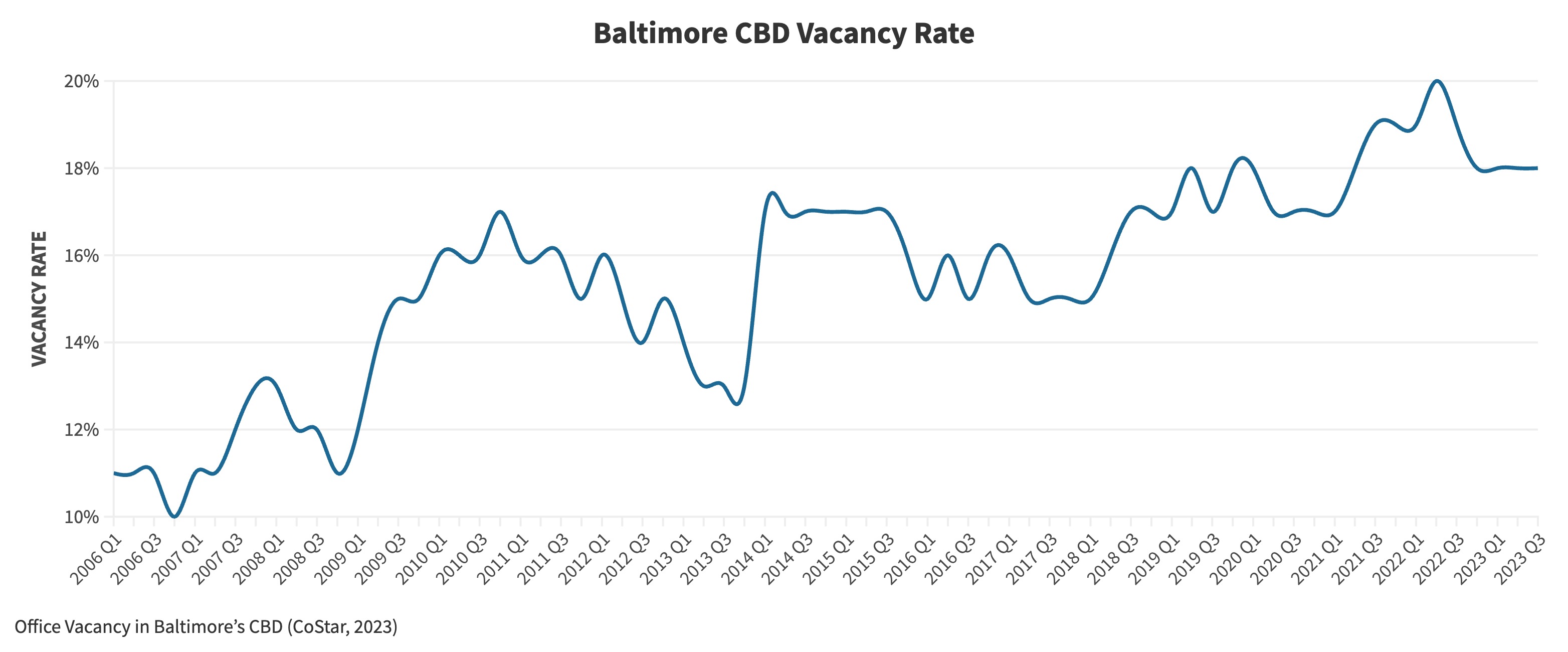

Baltimore’s Central Business District saw increased leasing in 2022 thanks to the relocation of 12 state agencies. Despite this rebound, office vacancies in the CBD remain near record highs at 18.2%, according to CoStar data. Several marquee tenants in downtown Baltimore, like T. Rowe Price, Transamerica, Bank of America, and RBC Wealth Management, left or have plans to move from the CBD for Harbor East or Harbor Point. This flight to quality continues to push vacancies higher.

And as remote and hybrid work continues to gain popularity, the question remains: what will happen to vacant office buildings? One potential remedy is converting to multifamily, but developers face several challenges.

– OBSTACLES –

1. Building Structure

100 Light Street, the tallest tower in the Baltimore Central Business District, currently contains almost 200K SF of vacant office space (Loopnet, 2023)

Some buildings just don’t work. Properties designed for office space often do not meet the standards of multifamily use. One common issue is a lack of windows and the high costs of adding them. Developing appealing apartment layouts in an existing structure adds difficulty.

2. Zoning

Many of the buildings in Baltimore’s CBD are office-use zoned

Rezoning a property is costly, both in money and time. In Baltimore City, a property owner must develop a comprehensive plan for the area. They must also prove the change or mistake criteria, providing substantial evidence there has been, “change to the area that was not anticipated”. Rezoning requires approval by both the mayor and city council and includes two public hearings.

3. Existing Tenants

Many office buildings remain partially leased, but the best-case scenario for a developer is a fully vacant property. The additional expense of buying tenants out of their leases is costly, and waiting for leases to expire could add years to a project timeline.

4. Lack of Incentive

120 W. Fayette is a fully vacant, recently renovated, 169K SF office building in the Baltimore CBD. Baltimore Gas and Electric owns the property; its future use remains unknown. (Loopnet, 2023)

Several cities have responded to the vacancy by initiating tax credit programs for conversion projects, such as the high-performance market-rate rental housing tax credit in Baltimore City and the Housing in Downtown (HID) Abatement in Washington, DC. Still, the rising interest rate environment has sent many investors to the sidelines. Financing continues to prove difficult, and rising construction costs exacerbate the issue.

– ON THE BRIGHT SIDE –

Central Savings Bank Apartments* is a mixed-use complex in Downtown Baltimore. Once a mix of offices and retail, the property was gut-renovated and converted in 2016 to feature 24 residential units and four retail spaces.

*Denotes HSA Transaction

Office conversion was successfully pulled off in Baltimore long before the CoronaVirus Pandemic impacted office use, and experts expect the trend to continue. To date, the city ranks fourth in the nation for multifamily conversions.