Pictured: Bethesda, MD (Montgomery County)

Maryland Multifamily Overview

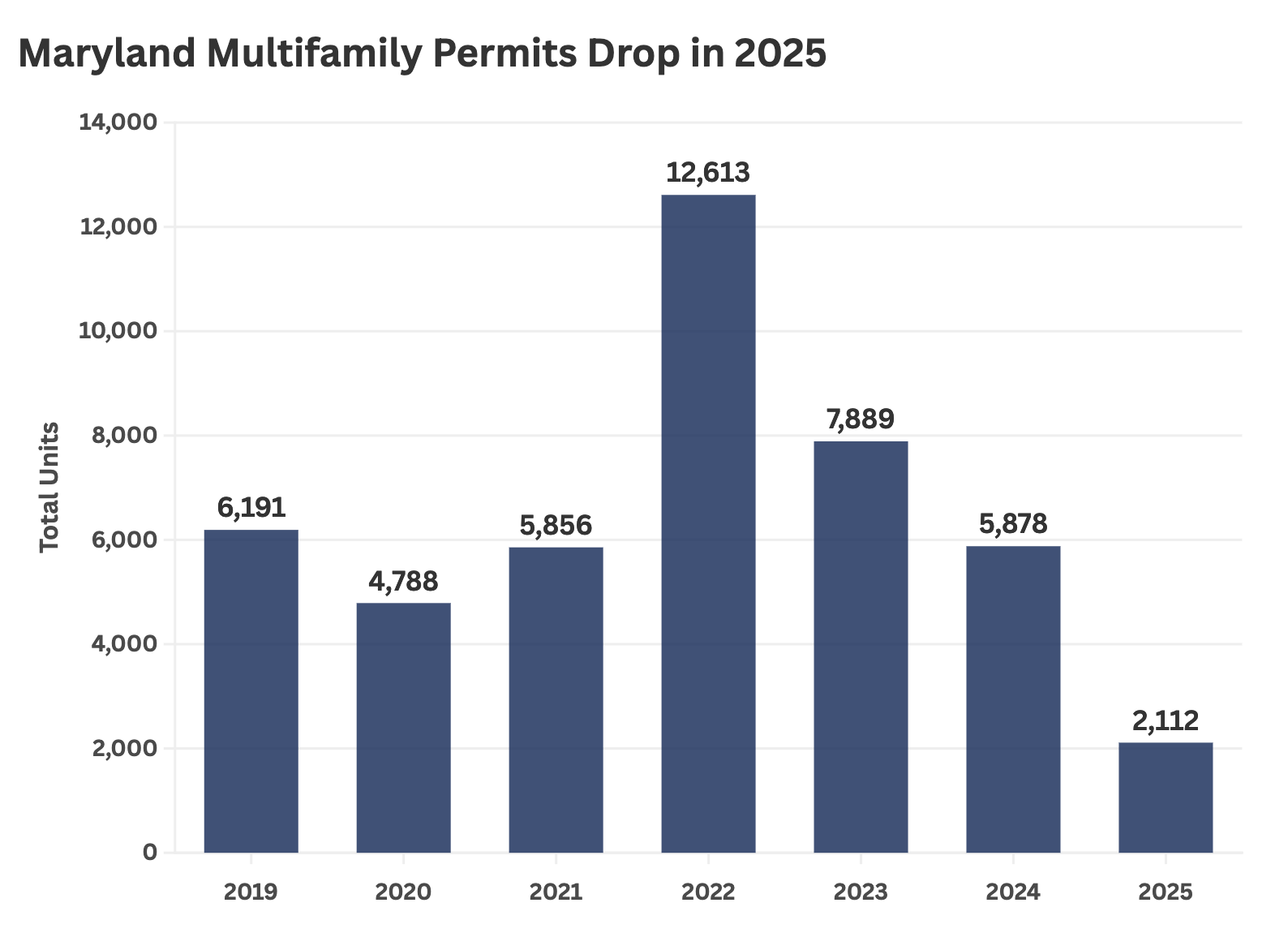

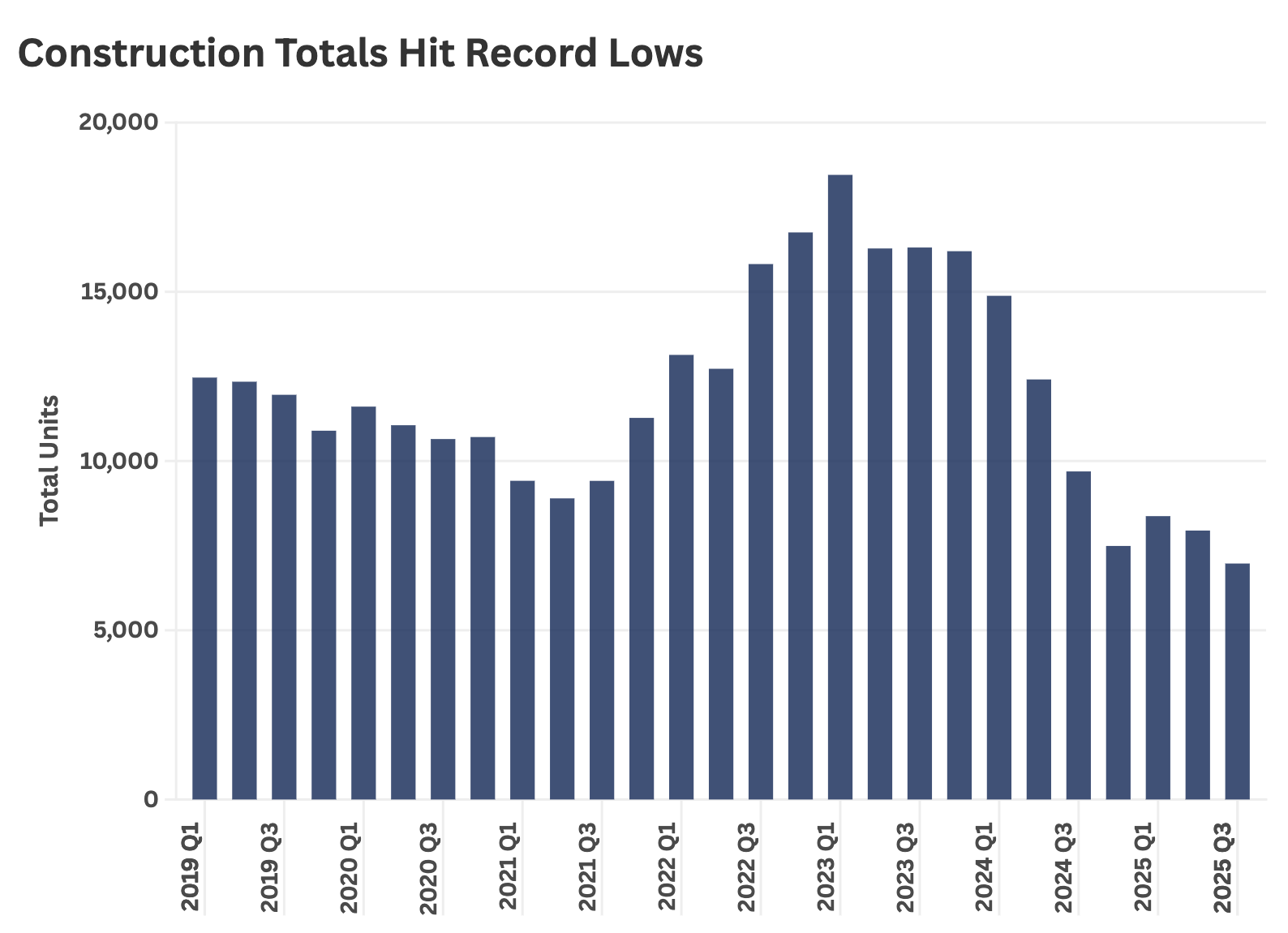

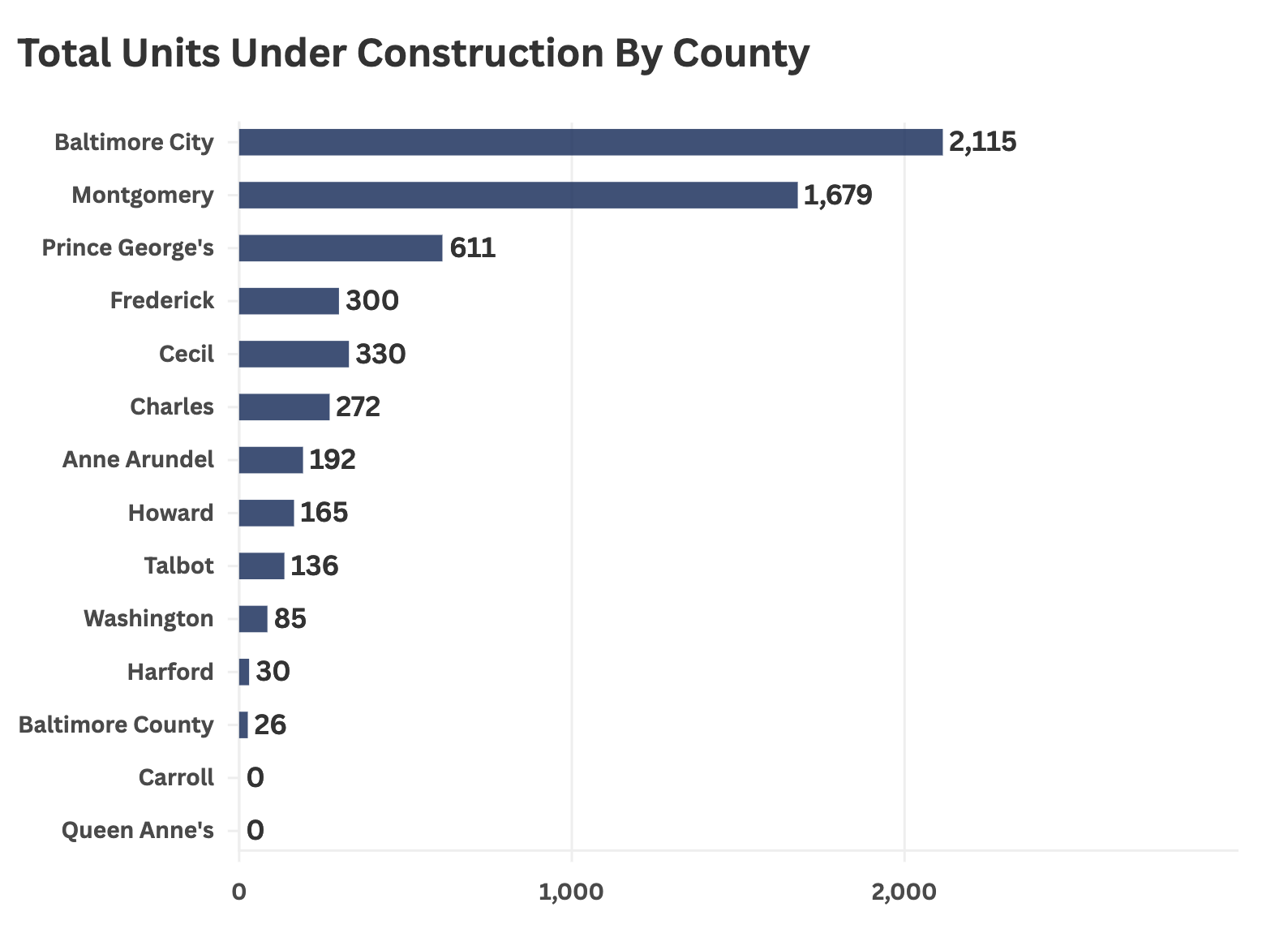

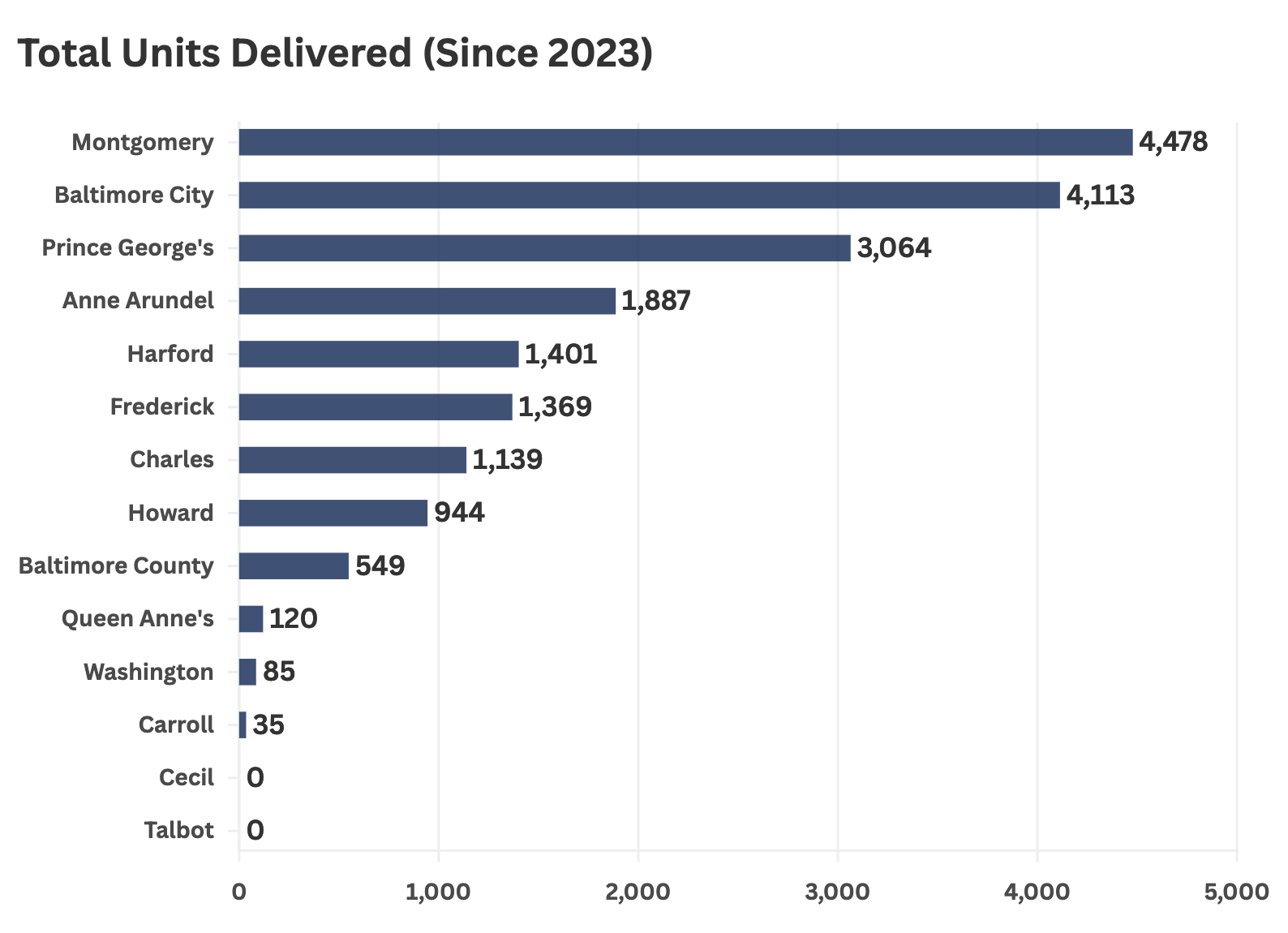

Maryland’s multifamily market is entering a new phase. The historic supply wave is now firmly in the rearview mirror, with more than 10,000 units delivered in 2024, the first time the state has ever crossed that milestone. Since then, the construction pipeline has shifted sharply. Units under construction are down 30% year-over-year and more than 50% from the 2022 peak, while new permits have dropped dramatically in the first half of 2025. These trends point to a sustained tightening in Maryland’s development pipeline.

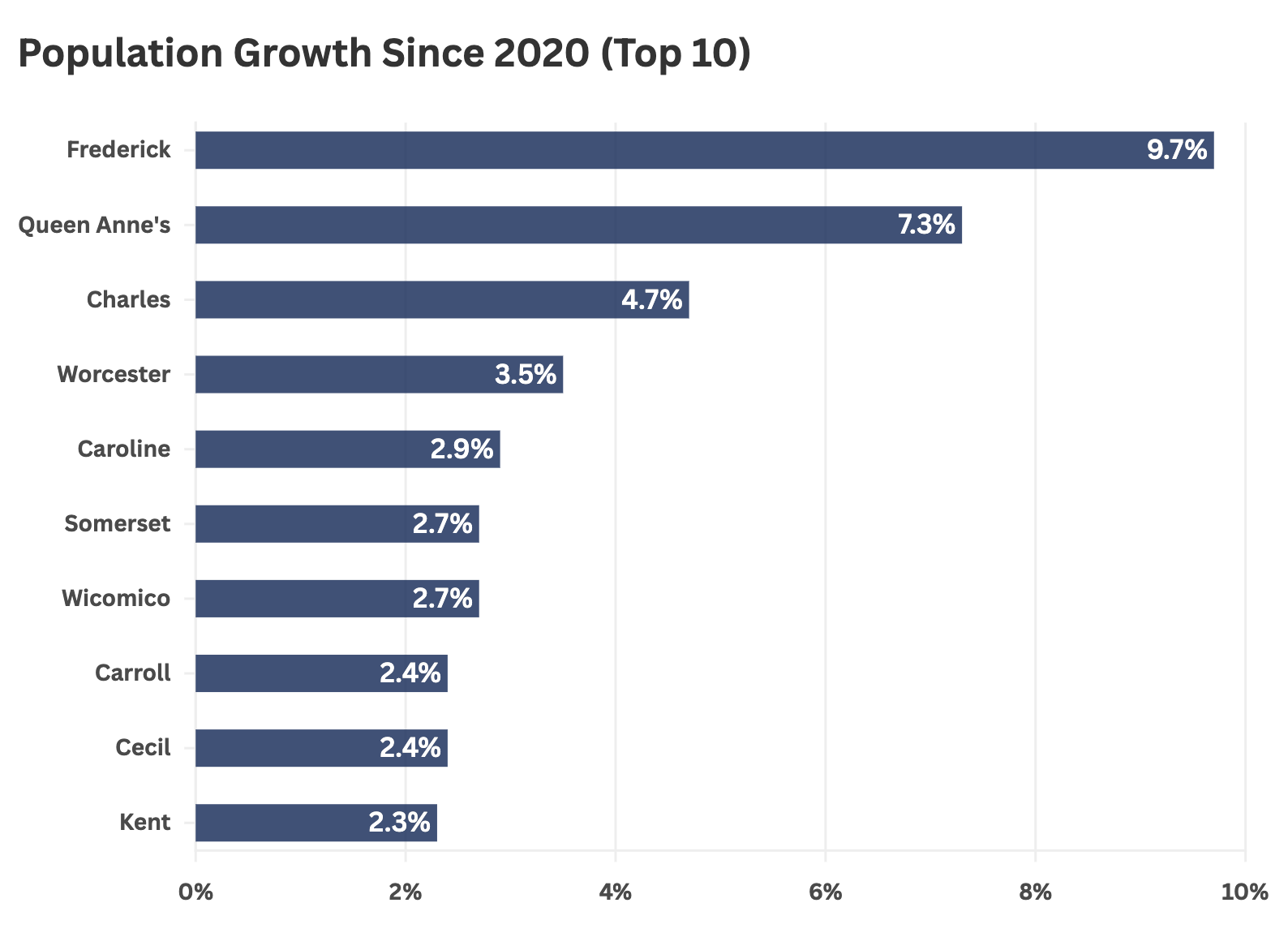

On the demand side, population growth is accelerating, fueled by out-of-state companies expanding into Maryland and creating jobs. This wave of economic activity is supporting stronger housing demand just as new supply is set to contract, a dynamic that could reshape fundamentals heading into 2026. Rent performance remains bifurcated: supply-heavy counties such as Baltimore City and Anne Arundel have seen moderation, while markets like Baltimore County continue to post steady rent growth.

Investment activity, meanwhile, reflects the broader national slowdown. Deal volume has retreated from historical norms as higher borrowing costs make traditional financing less feasible. To bridge the gap, buyers and sellers are relying on more creative structures, with short-term loans emerging as a popular option in anticipation of refinancing at lower rates. While “higher-for-longer” interest rates continue to weigh on activity, expectations for cuts later this fall could spark a more active close to 2025.

Source: U.S. Census Bureau

Source: CoStar

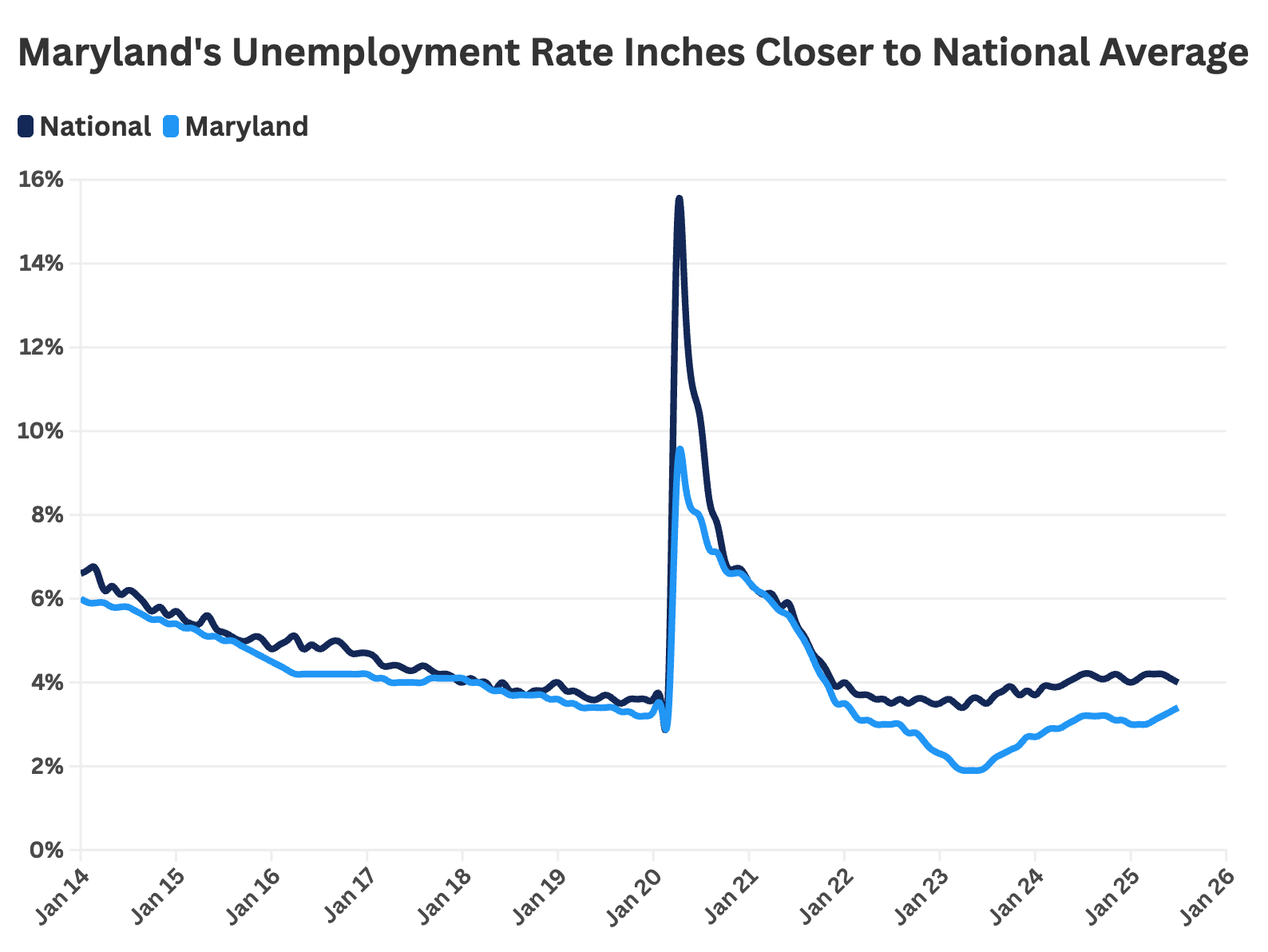

Employment

Maryland’s job market remains resilient, supported by a mix of healthcare, life sciences, defense, logistics, and professional services, even as federal workforce reductions create headwinds. As of July 2025, the state employed 2.85 million nonfarm workers, with the private sector accounting for roughly 2.3 million jobs. While federal layoffs have contributed to a decline of nearly 8,000 government positions since early 2025, private-sector industries have helped offset these losses with steady gains.

Among industries, education and health services are the standout drivers, adding nearly 8,000 jobs since February, while leisure and hospitality continues to strengthen as consumer activity rebounds. Professional and business services and manufacturing remain steady anchors, while trade, transportation, and utilities have softened slightly in recent months. This diversity, anchored by world-class institutions such as Johns Hopkins, the University of Maryland, and Fort Meade, ensures Maryland maintains a balanced employment base and sustained housing demand across its metro and regional markets.

Recent notable expansions include Blink Charging relocating its global headquarters to Bowie, AstraZeneca enhancing R&D in Montgomery County, and Syngene International opening a new biologics facility in Baltimore. IronCircle’s relocation to Columbia and Little Sesame’s new production plant in Prince George’s County highlight the state’s continued ability to attract diverse companies across high-growth sectors. Collectively, these moves are adding momentum at a time when Maryland is navigating a shifting federal jobs landscape.

Source: BLS

Baltimore Metro Anne Arundel, Baltimore City, Baltimore Co, Carroll, Harford, Howard

Occupancies have stabilized in 2025 as new supply has slowed, with total deliveries falling to their lowest level in more than a decade. This moderation comes at a critical time, as the metro continues to absorb the nearly 8,000 units delivered over the past two years. The influx of luxury Class A communities has pressured rent growth, which has recently softened in this segment. Looking ahead, annual deliveries are projected to decline by more than 65% from 2024 to 2025, reaching their lowest mark since 2010.

Development activity remains concentrated in Baltimore City, which accounts for roughly 85% of all units underway. Construction is clustered in Downtown, Canton, Fells Point, and the Baltimore Peninsula. Outside the city, Anne Arundel County has emerged as a development hub, with notable activity in Annapolis and Jessup. The county saw more than 1,000 units delivered in 2024, its highest annual total in over a decade.

On the investment front, transaction activity has moderated in 2025 compared to the first half of last year. Institutional capital remains cautious, and only three properties larger than 100 units traded in the first two quarters. By contrast, Baltimore’s middle market continues to show resilience, as buyers rely on all-cash transactions, owner financing, and short-term loans from select regional banks to bridge the gap left by traditional financing. While overall deal volume is lower, buyer activity has picked up through the summer months, setting the stage for a potential rebound. If borrowing costs ease in the months ahead, Baltimore could see a renewed surge of capital flow into its multifamily market.

Source: CoStar

Suburban D.C. – Montgomery, Prince George’s

Like most of the state, Montgomery and Prince George’s County saw a development boom, with nearly 4,500 units completed last year. Construction starts have slowed rapidly, along with the number of permits approved, and supply is likely to hit historic lows over the next several years. Similarly, investment has also slowed, as rent stabilization in both counties took effect in 2024.

Montgomery County’s Rent Stabilization law took effect in July 2024, capping annual rent increases at 5.7% in 2025 for properties 23 years or older, with exemptions for newer properties and certain housing types. Landlords may exceed the cap through banking, Capital Improvement, or Fair Return petitions. Takoma Park, however, operates under its own longstanding rent stabilization ordinance enacted in 1980, limiting increases to the Consumer Price Index (2.4% in 2025) with only a five-year exemption for new construction and no substantial renovation carve-outs.

Prince George’s County’s Permanent Rent Stabilization and Protection Act took effect in October 2024, also capping increases at 5.7% for most units and allowing similar petitions for increases above the cap. While both counties share the same overall framework, Montgomery uses a rolling 23-year threshold and offers a substantial renovation exemption, whereas Prince George’s applies a fixed cutoff for any property built in 2000 or later.

Pictured: North Beach, MD (Calvert County)

Southern MD – Calvert, Charles, St. Mary’s

With a continued uptick in deliveries throughout 2025, the region’s vacancy rate rose slightly. Steady population growth has anchored absorption recently, with the tri-county area adding more than 12,000 new residents since 2021, a 3.3% increase. Major employers across Southern Maryland include Naval Air Station Patuxent River, Charles County’s education system and Naval Support Facility Indian Head, and Calvert Memorial Hospital.

Construction activity remains active in Charles County, which accounted for all new deliveries and active developments recently. As of Q3 2025, fewer than 300 units are under construction, while more than 1,000 units have been delivered since the start of 2024. By contrast, there are no active developments underway in St. Mary’s or Calvert Counties. Investor activity is robust for multifamily properties, thanks to the appeal of the connectivity to D.C. and the continued population gains.

Pictured: Downtown Frederick (Frederick County)

Western MD – Allegany, Frederick, Garrett, Washington

Frederick County continues to lead Maryland in population growth, adding more than 26,000 residents since 2021, an increase of nearly 10%. Its strategic location, with direct access to top talent in both Washington, D.C., and Baltimore, has positioned the county as more than just a commuter hub. Frederick boasts a diversified economy anchored by life sciences, biotechnology, information technology, advanced manufacturing, healthcare, and education, creating a strong foundation for apartment demand.

Frederick has also experienced a development boom over the past two years, with more than 1,350 units delivered. Vacancies have begun to decrease as the market absorbs this influx, but supply-side pressure is likely to remain minimal with construction levels down more than 40% year-over-year.

Washington County has not experienced the same level of multifamily development, despite continued population growth. The county’s rental market is primarily concentrated in Hagerstown, which benefits from a robust education system and serves as the region’s economic hub. Allegany and Garrett Counties represent the smallest multifamily markets in Western Maryland. Allegany’s economy is anchored by Frostburg State University and the Western Maryland Health System, while Garrett’s is driven primarily by tourism around Deep Creek Lake.

Eastern Shore – Caroline, Cecil, Dorchester, Kent, Queen Anne’s, Somerset, Talbot, Wicomico, Worcester

Maryland’s Eastern Shore encompasses a diverse group of counties, but each has maintained one key characteristic: population growth. The region includes seven of the state’s top ten counties for population growth, supporting steady demand for apartments despite its predominantly rural character.

Cecil and Queen Anne’s Counties benefit most directly from proximity to the Baltimore-Washington metro, with strong commuter links supporting steady housing demand. Queen Anne’s has also attracted higher-income households seeking suburban waterfront living, while Cecil continues to experience industrial and logistics-driven growth tied to its I-95 corridor location.

Talbot, Kent, and Caroline Counties have smaller populations but maintain consistent growth tied to local employment bases in education, healthcare, and agriculture. Dorchester has garnered incremental attention through revitalization efforts in Cambridge, which has supported limited but targeted interest in multifamily development.

Farther south, Wicomico County anchors the lower Eastern Shore with Salisbury, a regional hub for education, healthcare, and distribution. Salisbury University and TidalHealth drive steady rental demand, and Wicomico remains one of the more active multifamily markets in the region. Worcester and Somerset Counties, meanwhile, are heavily influenced by seasonal activity. Ocean City in Worcester generates significant tourism-driven housing demand, while Somerset, anchored by the University of Maryland Eastern Shore, maintains a year-round rental base.