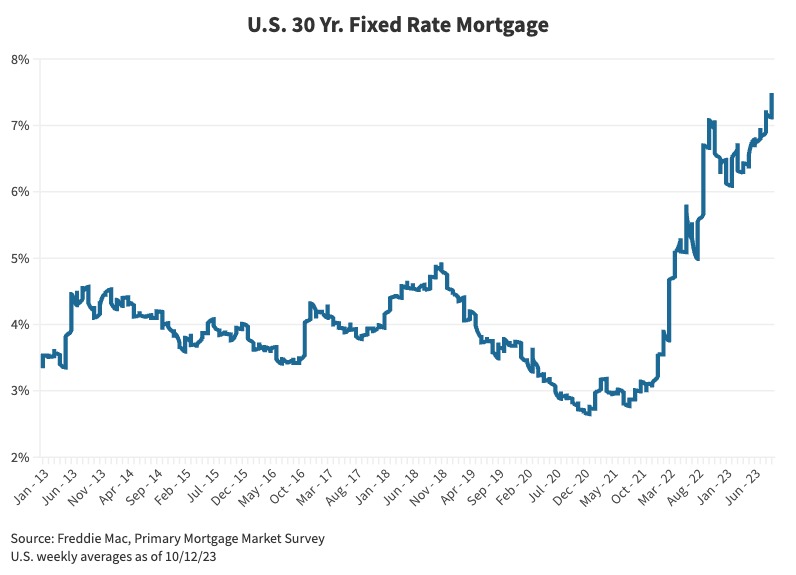

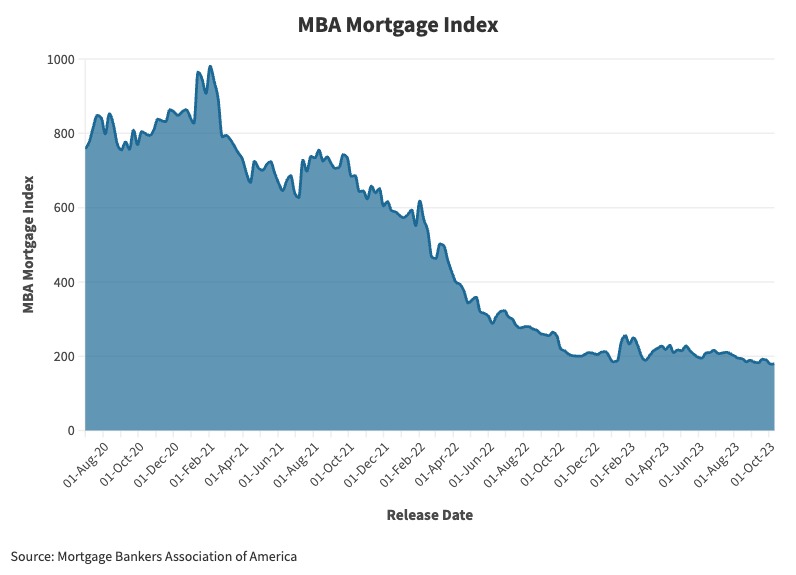

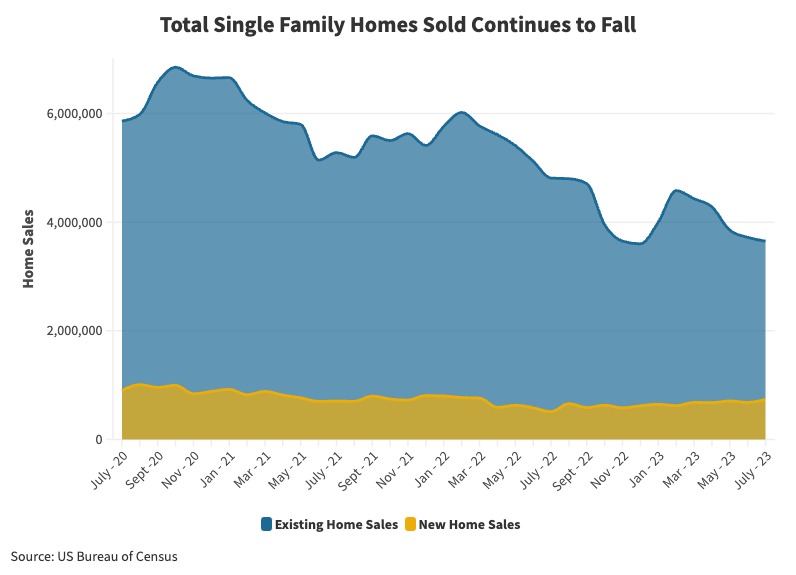

Many renters will likely have no option but to continue renting as the single-family housing market softens nationwide. With mortgage rates at 20-year highs and low inventory levels, mortgage applications have fallen to the lowest level in over three decades.

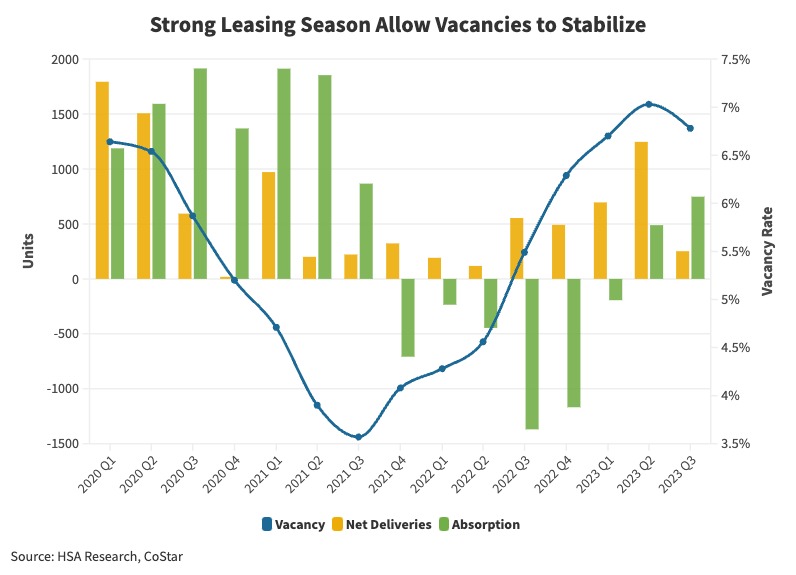

This lack of supply of homes for sale has kept pricing elevated, deterring many would-be homebuyers, which will add more renters to the apartment market in the near term. This led to a strong leasing season in 2023 for the Baltimore MSA, allowing vacancy rates to stabilize over the past several quarters. Rates currently sit just above the metro’s long-term average of roughly 6%.

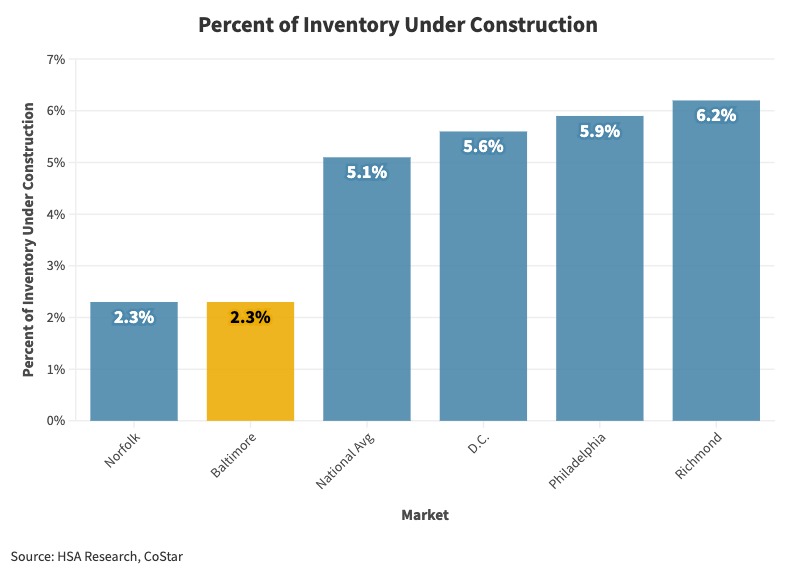

This increased demand is likely to impact rent growth positively in select markets. Demand is only one side of the equation, as the delivery of new apartment buildings could combat this growth in heavy supply markets. In the Mid-Atlantic, Baltimore is well-positioned for rent increases. The total supply is well below the national average for total units under construction as a percentage of inventory. According to CoStar data, the Baltimore MSA has 2.3% of its inventory underway, whereas the national average is 5.3%.

With a tough single-family market and low multifamily supply in Baltimore, staying on top of key indicators impacting renter demand is crucial. Here are the top ones we are watching:

1. Mortgage Rates

2. Mortgage Applications

3. Existing & New Home Sales

4. Multifamily Fundamentals (Supply, Demand, & Vacancy)

5. Percent of Multifamily Inventory Under Construction