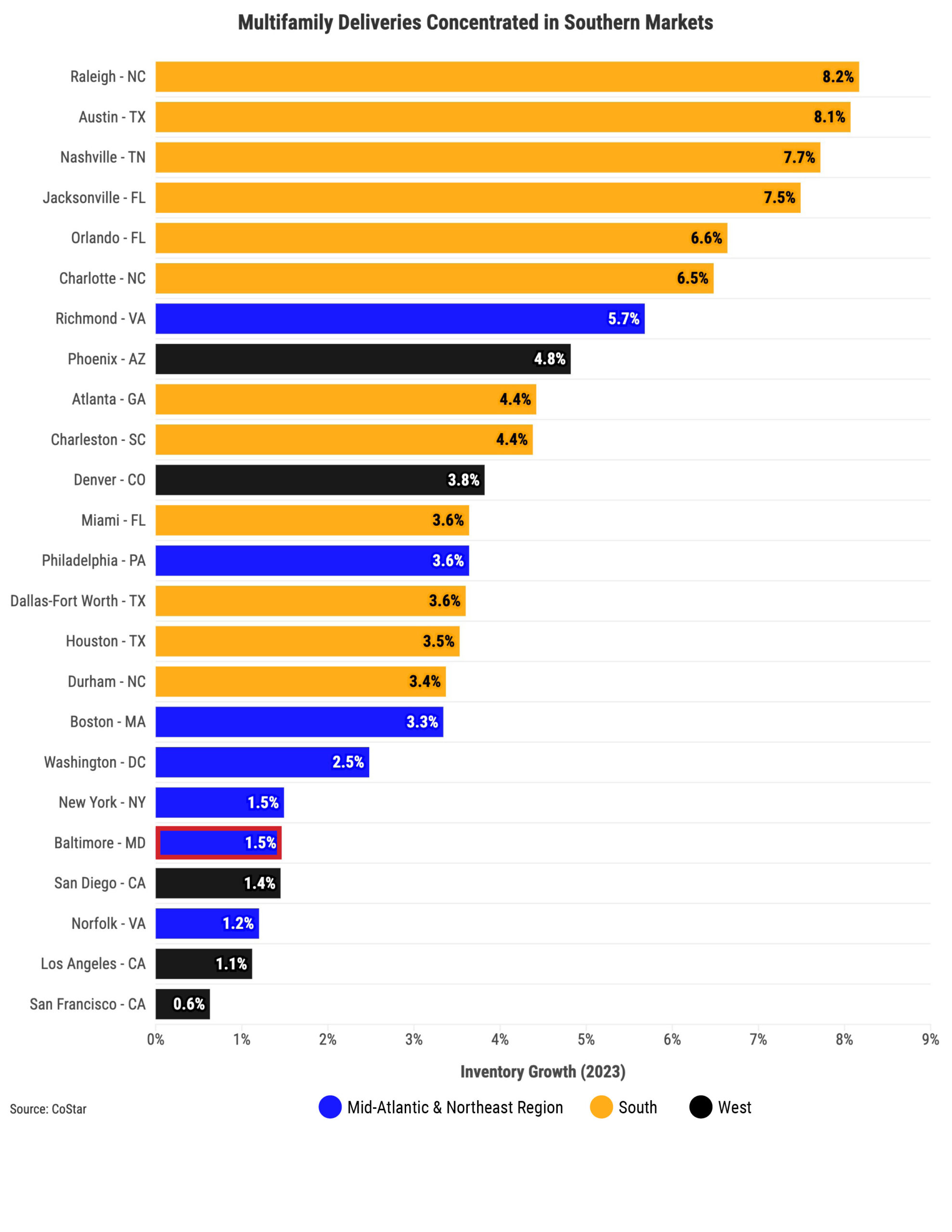

In 2023, the U.S. witnessed a historic surge in multifamily deliveries, with over 570,000 units completed, marking the highest annual total on record, according to CoStar data. This influx represents a notable inventory increase of over 3%, whereas Baltimore’s inventory expanded just 1.4% during that time. This lack of supply-side pressure has allowed Charm City landlords to push rents greater than many major metros nationwide.

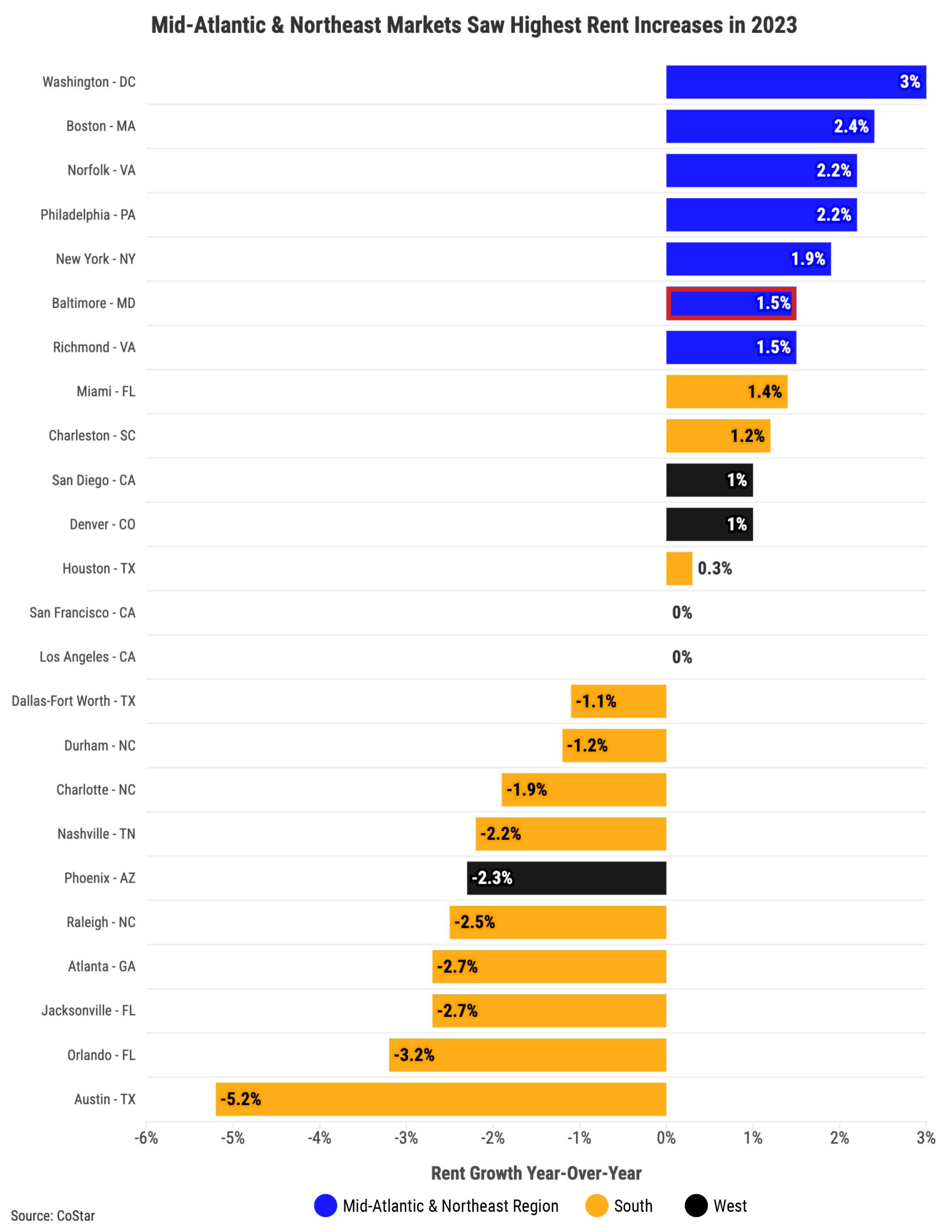

Rent growth in Baltimore outpaced fast-growing markets like Miami, Nashville, Phoenix, and Raleigh. Renter demand saw a noticeable uptick during the 2023 leasing season, and that momentum carried over into the winter months as well.

As a result of this increased demand, occupancies in Baltimore only saw a slight decrease of roughly 50 basis points, while the national average was nearly double. Construction is anticipated to slow in the coming years, primarily driven by elevated financing costs, suggesting that overall supply might plateau after 2024.

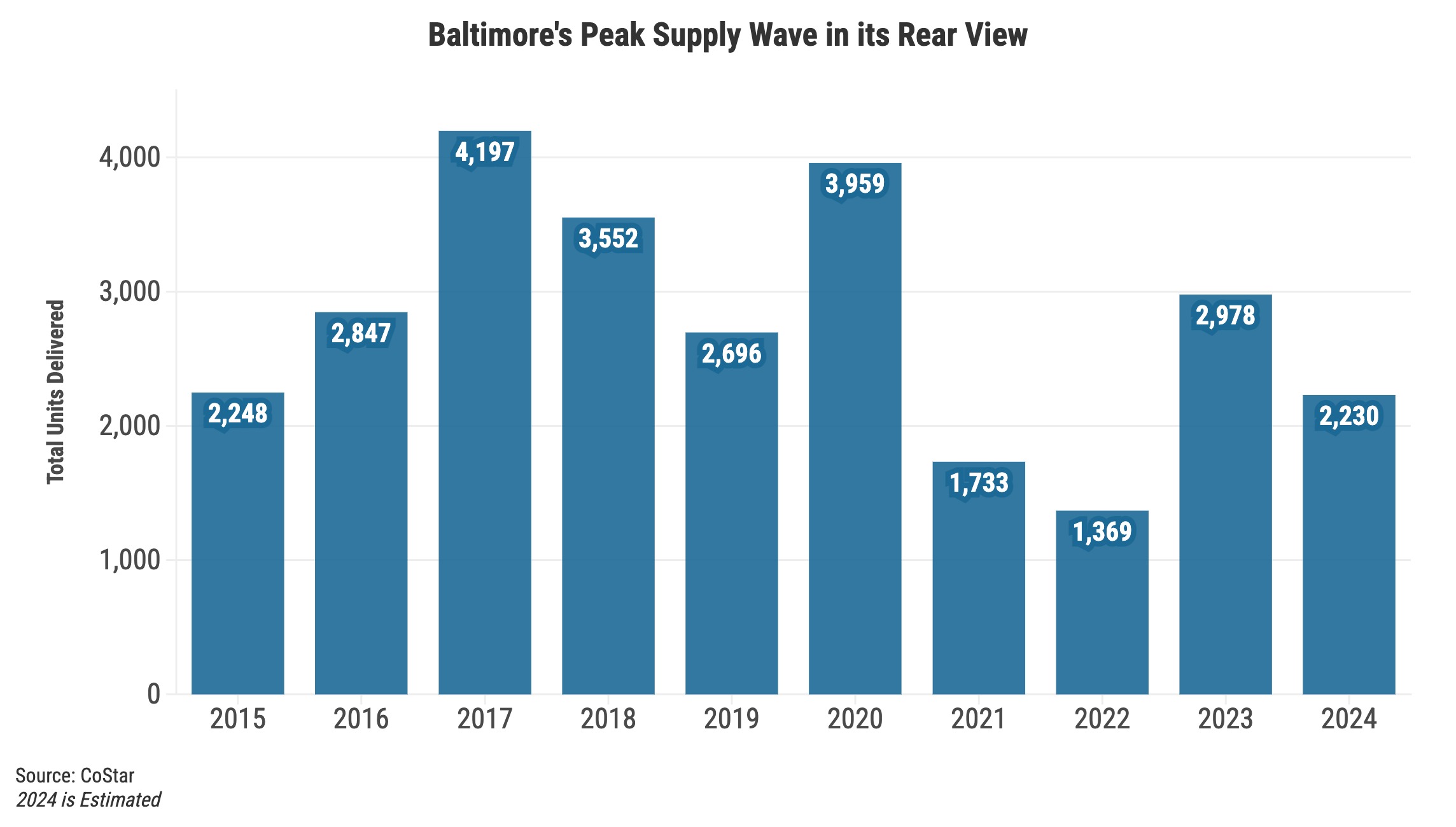

The correlation between supply and rent growth is evident, and Baltimore stands out in this landscape. Multifamily construction in Baltimore peaked between 2017 and 2020, delivering nearly 14,500 units. Over the past three years, just over 6,000 units entered the market, reflecting a decrease of approximately 40% in total units delivered annually. This trend is expected to persist in 2024, with an estimated 2,200 units projected to complete. As construction costs remain high, further decreases in construction activity are anticipated in the subsequent years. This shift will likely favor landlords and investors, as rent growth is expected to increase in the coming years.

The Mid-Atlantic, Northeast, and West markets experienced a decline in overall construction activity. Baltimore, New York, San Diego, Norfolk, L.A., and San Francisco recorded inventory growth below 1.5% in the past year. Conversely, In 2023, over half of all multifamily deliveries occurred in the South, with standout markets like Raleigh, Austin, Nashville, and Jacksonville leading the way. Rents in much of the Sunbelt could continue its downward trajectory due to the large concentration of supply.

The influx of supply in southern markets has significantly impacted landlords’ ability to raise rents. Most metro areas in these regions have witnessed declines in year-over-year rent growth, with Atlanta, Orlando, and Austin experiencing the most substantial decreases. Meanwhile, markets with lower supply-side pressure have seen rent increases of 1.5% or greater.