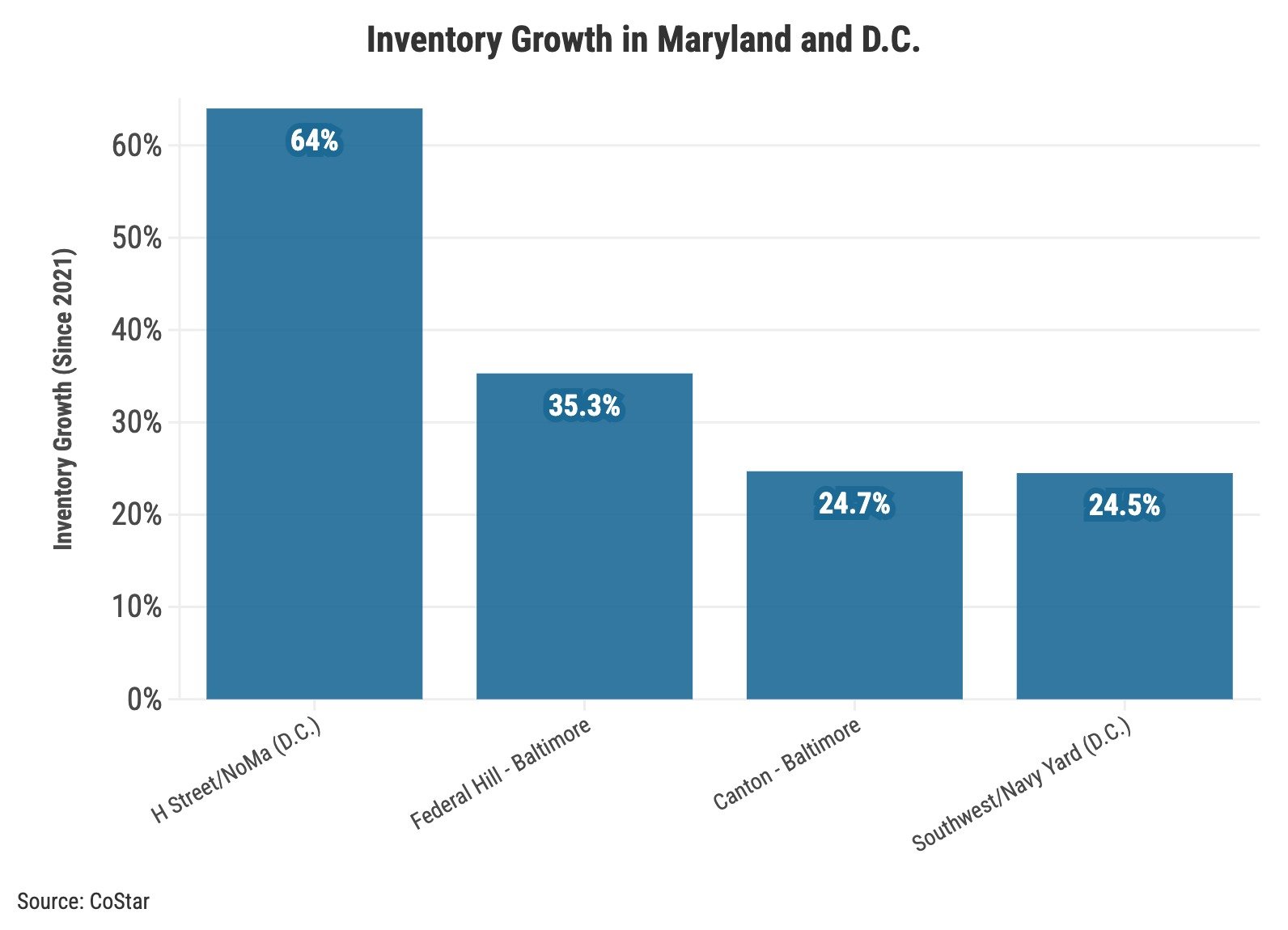

Multifamily completions picked up nationwide in 2023, with more than 570,000 units opening their doors. However, Mid-Atlantic markets experienced fewer deliveries than many parts of the country, mainly in the South. A handful of neighborhoods in Baltimore and D.C. continue to expand and draw high interest from renters. Here are the top submarkets in terms of inventory growth in the past three years.

1. H Street/NoMa (D.C.) – 6,500+ Units Delivered (64% Growth)

H Steet /Noma has become one of the region’s most sought-after locations for renting, and developers have added more than 6,500 units since 2021 and more than 8,500 units in the past five years. The submarket encompasses the lively H Street and neighborhoods of NoMa (North of Massachusetts Avenue) and Union Market. The U.S. Securities and Exchange Commission (SEC) remains its top employer despite the concerns of its future HQ and its 4,500 employees. With asking rents hovering around $2,675 per unit, the area is still more affordable than a popular area like Southwest/Navy Yard.

2. Federal Hill (Baltimore) – 750+ Units Delivered (35% Growth)

Federal Hill remains the top spot for the young professionals of Baltimore City. The submarket’s inventory grew by more than 35% in the past three years, and nearly 10% of its inventory is under construction. Retail developments like Cross Street Market and its proximity to M&T Bank Stadium (home of the Baltimore Ravens) and Camden Yards (Baltimore Orioles) continue to lure renters to the submarket.

3. Canton (Baltimore) – 1,350+ Units Delivered (25% Growth)

Similar to Federal Hill, Canton supports a typically younger renter-driven demographic with high walkability to retail and nightlife. The area boasts the highest asking rents ($2,181/unit) among any other submarkets in the Baltimore MSA, with Annapolis ($2,162/unit) and Federal Hill ($2,121/unit) not far behind. The consistent demand for rentals has led to a large construction wave of more than 1,350 units built since 2021.

4. Southwest/Navy Yard (D.C) – 3,700+ Units Delivered (25% Growth)

The Southwest-Navy Yard area is a former industrial hub with tremendous growth in the past decade and recent years. The catalyst was the arrival of Nationals Park, home of Major League Baseball’s Washington Nationals. Commercial development has persisted since then, including the completion of nearly 10,000 units in the past five years, more than doubling its total inventory. More recently, the final phase of The Wharf was completed in 2022, a $3.6 billion mixed-use development along the Southwest waterfront.